Tìm Kiếm Bài Đã Đăng

Diễn Đàn Cựu Sinh Viên Quân Y

© 2014

© 2014

Chapter Eleven

Exchange-Traded Funds or ETFs

ETFs is a rather new concept of investing, combining the advantages of stocks and mutual funds. In general, stocks are considered riskier than mutual funds, the latter having the main advantage of diversification but cannot be traded during trading hours and commission fees are costlier than stocks. Also, mutual funds cannot be bought on margin and there are no options trading, thus lacking the possibility of leverage as with stocks.

ETFs are considered investment funds that invest in a basket of securities (stocks, bonds, other financial vehicles...) or commodities similar to mutual funds but are traded on stock exchanges in small units over the course of the trading day. From the perspective of brokerage firms, those small units are treated like stocks and can be traded as such.

How an ETF is formed?

Each ETF has a specific goal to achieve and at the beginning, most ETFs track or mimic the performance of an index, such as a stock index or bond index. Recently, ETFs have been expanded considerably to comprise leveraged ETFs (to double or triple the index performance), commodities ETFs (called CETFs), and believe it or not, ETFs that want to lose money by permanently betting against the market (Proshares Short categories). Of course there is a reason for everything and those reverse-ETFs are mostly used by funds managers to hedge against a market downturn.

For the sake of illustration, let's suppose there is an index called the High Flying Social Media Index that follow the performance of social media companies consisting only of Facebook (FB), Twitter (TWTR), and Lindkedln (LNKD). For your information, there is a real Social Media Index called Global X Social Media Index and the ETF is SOCL.

Obviously many investors would be undecided which company to buy among the three. Therefore a financial firm may decide to create an ETF called the FTLY to track that High Flying Social Media Index. First, it pools a capital, for example $100 M and buys all three companies, more or less according to their capitalizations. Then the whole $100M is divided into small units that bear the ticker symbol FTLY. Let's suppose again that the fund management issues 1M shares. Each share therefore is worth $100. After filing according to laws and regulations, FTLY can be put and traded on exchanges.

Only authorized participants which are large broker-dealers having agreements with the ETF's distributor can actually buy or sell shares of an ETF directly from or to the ETF itself but in large numbers called "creation units" of tens or hundreds of thousands at a time. They purchase or redeem creation units in-kind , contributing or receiving a basket of securities of the same type and proportion held by the ETF. Other investors such as small investors can buy the ETF using a retail broker.

When authorized dealers buy FTLY creation units, the fund manager uses the money to buy more FB, TWTR and LNKD on the open market. If authorized dealers sell FTLY creation units, the fund manager pays the authorized dealers and keeps the shares.

At any moment because of strong demand, FTLY may rise in price more than its actual net asset value (consisting of the three companies), the authorized dealers may see an opportunity of arbitrage. They can sell FTLY and buy a correspondent amount of the three companies on the open market. The opposite occurs when FTLY is down temporary compared to its net asset value, the authorized dealers will buy FTLY and sell the actual three companies in the open market. This arbitrage mechanism helps to keep FTLY price close to the index and reflects almost instantaneously the true value of the three companies combined.

History

The first ETF ever created was the Index Participation Shares, an S&P 500 proxy that traded on AMEX and Philadelphia Stock Exchange in 1989. However this product was short-lived after a successful lawsuit by the Chicago Merchantile Exchange, referring SEC regulations and stopping its sales in the USA.

The next year, in 1990 the Toronto Stock Exchange in Canada initiated a similar ETF that tracks the TSE 35 and later the TSE 100 indexes. The launch proved to be triumphant. Its popularity led AMEX to try to circumvent SEC laws. In 1993, Nathan Most and Steven Bloom, under the direction of Ivers Riley, designed and developed S&P 500 Depositary Receipts <https://en.wikipedia.org/wiki/Standard_%26_Poor%27s_Depositary_Receipts> known as the SPY. The fund soon becomes the largest fund in the world. In May 1995, the MidCap SPDRs (MDY) is introduced. They are knowns as SPDRs or "Spiders."

In 1996, Barclays Global Investors created World Equity Benchmark Shares (WEBS) later renames as iShares MSCI Index Shares. WEBS tracks a number world countries indexes, originally 17 and gives small investors easy access to foreign markets.

In 1998, State Global Advisors follows the trend and introduced the "Sector Spiders" which mimic nine sectors of the S&P 500. The same year, "Dow Diamonds" Trust (NYSE: DIA) which follows the famous Dow Jones Industrial Average. Buy buying DIA, investors are essentially purchasing a stock that acts like the DIA index, but much simpler in transaction. Investors are no longer required to buy all Dow Jones 30 stocks in order to imitate Dow Jones performance.

In 1999, QQQ was launched to copy the performance of Nasdaq 100 or the 100 largest companies of NASDAQ.

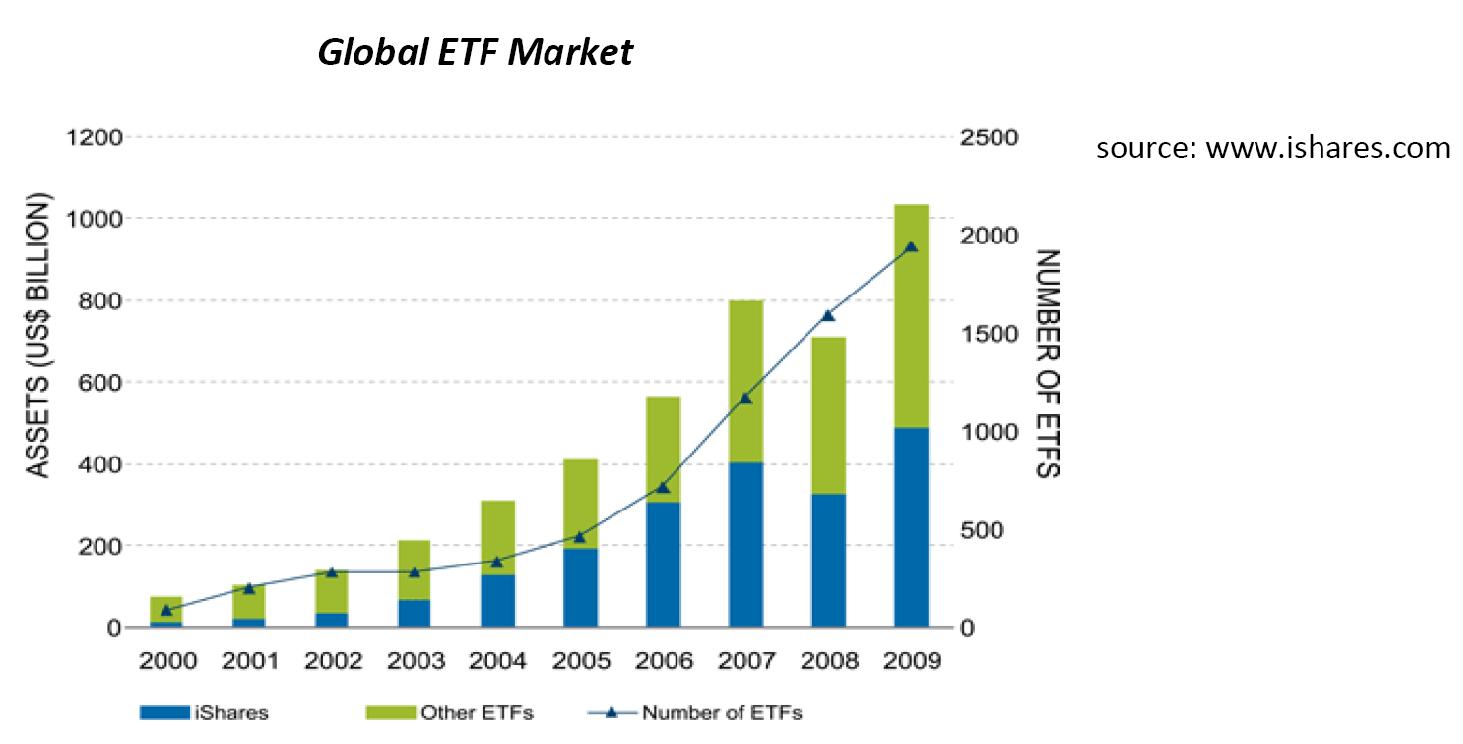

In 2000, Barclays Global Investors boosted the ETF market place with a more complete line of iShares, encompassing almost every aspects of the financial market and emphasizing on education and distribution to outreach long=term investors. Within five years, iShares line surpasses any other ETF in assets in the U.S. and Europe. Barclays Global Investors later on was acquired by BlackRock in 2009.

In 2001, the Vanguard Group was initiated and since then ETFs have gained an unseen popularity because of their flexibility to tailor to any investor' need to follow geographic regions, industrial sectors, commodities, bonds, futures, and any other asset. By now in 2014 there are more than 1,500 ETFs traded in the U.S. with over $1.7 trillion in assets.

Advantages of ETFs compared to Mutual Funds

Diversification. ETFs share this advantage with mutual funds by investing into a large array of companies, thus avoiding company specific risks. However diversification of ETFs should be taken in consideration with their correspondent goals. For example, an ETF that tracks the performance of biotechs may help the investor not to lose money on a specific company that goes bankrupt but cannot shield the investor of biotechs downturn as a whole.

Lower costs. ETFs have typically lower costs than mutual funds because they are not actively managed and simply follow a certain index. Investors are exempt of transaction costs involving with the buying and selling of numerous stocks in the ETF. Advertisement, marketing, distribution, and accounting expenses are also insignificant. Actually, Vanguard Group can charge only as low as $1 per transaction if the investor meets certain conditions of long-term investment.

Buying and selling flexibility. Unlike mutual funds, ETFs are considered stocks, therefore they can be traded as such on the secondary market with the advantages of buying on margin, selling short, options, and the ability of using every kinds of orders such as market order, limit order, stop order, etc... ETFs can be traded instantly during trading day with bid and ask price identical to any stock. Mutual funds shares can be traded only at the close based on their NVA (net value asset).

Tax efficiency. Taxes are collected only if there are gains when selling the stocks. In this case, because all stocks comprising the ETF are almost never sold, very little capital gains are generated. ETFs fund managers don't have to sell securities to meet investors redemption. Therefore, small investors report taxes only on dividends received and capital gains when they sell the ETFs. A long-term investor can see his ETFs egg-nest growing with some sort of tax-deferred feature.

Transparency. As required by SEC, ETFs whether index or actively-managed funds, have transparent portfolios and are priced at frequent intervals throughout trading day, sometimes as fast as 15 seconds each.

Criticism

Some analysts have argued that ETFs are used by many short-term fund managers and their trading expenses diminished returns to investors. Also, ETFs that buy and hold commodities such as previous metals (gold, silver...) may contributed to an unsustainable prices' appreciation of such commodities.

From the perspective of emerging markets, ETFs and leveraged ETFs can pose financial stability risks if equity prices of those countries were to decline for a long period.

A survey from Morgan Stanley shows that the returns of ETFs during the 2009 period missed their target by as much as 1.25% compared to the correspondent indexes due to tracking errors and miscalculated baskets of assets held.

Some critics even claim that ETFs can be and have been used to manipulate market prices, including short selling that may lead to exaggerated sell-offs and leading to financial markets collapses.

Exchange-Traded Funds or ETFs

ETFs is a rather new concept of investing, combining the advantages of stocks and mutual funds. In general, stocks are considered riskier than mutual funds, the latter having the main advantage of diversification but cannot be traded during trading hours and commission fees are costlier than stocks. Also, mutual funds cannot be bought on margin and there are no options trading, thus lacking the possibility of leverage as with stocks.

ETFs are considered investment funds that invest in a basket of securities (stocks, bonds, other financial vehicles...) or commodities similar to mutual funds but are traded on stock exchanges in small units over the course of the trading day. From the perspective of brokerage firms, those small units are treated like stocks and can be traded as such.

How an ETF is formed?

Each ETF has a specific goal to achieve and at the beginning, most ETFs track or mimic the performance of an index, such as a stock index or bond index. Recently, ETFs have been expanded considerably to comprise leveraged ETFs (to double or triple the index performance), commodities ETFs (called CETFs), and believe it or not, ETFs that want to lose money by permanently betting against the market (Proshares Short categories). Of course there is a reason for everything and those reverse-ETFs are mostly used by funds managers to hedge against a market downturn.

For the sake of illustration, let's suppose there is an index called the High Flying Social Media Index that follow the performance of social media companies consisting only of Facebook (FB), Twitter (TWTR), and Lindkedln (LNKD). For your information, there is a real Social Media Index called Global X Social Media Index and the ETF is SOCL.

Obviously many investors would be undecided which company to buy among the three. Therefore a financial firm may decide to create an ETF called the FTLY to track that High Flying Social Media Index. First, it pools a capital, for example $100 M and buys all three companies, more or less according to their capitalizations. Then the whole $100M is divided into small units that bear the ticker symbol FTLY. Let's suppose again that the fund management issues 1M shares. Each share therefore is worth $100. After filing according to laws and regulations, FTLY can be put and traded on exchanges.

Only authorized participants which are large broker-dealers having agreements with the ETF's distributor can actually buy or sell shares of an ETF directly from or to the ETF itself but in large numbers called "creation units" of tens or hundreds of thousands at a time. They purchase or redeem creation units in-kind , contributing or receiving a basket of securities of the same type and proportion held by the ETF. Other investors such as small investors can buy the ETF using a retail broker.

When authorized dealers buy FTLY creation units, the fund manager uses the money to buy more FB, TWTR and LNKD on the open market. If authorized dealers sell FTLY creation units, the fund manager pays the authorized dealers and keeps the shares.

At any moment because of strong demand, FTLY may rise in price more than its actual net asset value (consisting of the three companies), the authorized dealers may see an opportunity of arbitrage. They can sell FTLY and buy a correspondent amount of the three companies on the open market. The opposite occurs when FTLY is down temporary compared to its net asset value, the authorized dealers will buy FTLY and sell the actual three companies in the open market. This arbitrage mechanism helps to keep FTLY price close to the index and reflects almost instantaneously the true value of the three companies combined.

History

The first ETF ever created was the Index Participation Shares, an S&P 500 proxy that traded on AMEX and Philadelphia Stock Exchange in 1989. However this product was short-lived after a successful lawsuit by the Chicago Merchantile Exchange, referring SEC regulations and stopping its sales in the USA.

The next year, in 1990 the Toronto Stock Exchange in Canada initiated a similar ETF that tracks the TSE 35 and later the TSE 100 indexes. The launch proved to be triumphant. Its popularity led AMEX to try to circumvent SEC laws. In 1993, Nathan Most and Steven Bloom, under the direction of Ivers Riley, designed and developed S&P 500 Depositary Receipts <https://en.wikipedia.org/wiki/Standard_%26_Poor%27s_Depositary_Receipts> known as the SPY. The fund soon becomes the largest fund in the world. In May 1995, the MidCap SPDRs (MDY) is introduced. They are knowns as SPDRs or "Spiders."

In 1996, Barclays Global Investors created World Equity Benchmark Shares (WEBS) later renames as iShares MSCI Index Shares. WEBS tracks a number world countries indexes, originally 17 and gives small investors easy access to foreign markets.

In 1998, State Global Advisors follows the trend and introduced the "Sector Spiders" which mimic nine sectors of the S&P 500. The same year, "Dow Diamonds" Trust (NYSE: DIA) which follows the famous Dow Jones Industrial Average. Buy buying DIA, investors are essentially purchasing a stock that acts like the DIA index, but much simpler in transaction. Investors are no longer required to buy all Dow Jones 30 stocks in order to imitate Dow Jones performance.

In 1999, QQQ was launched to copy the performance of Nasdaq 100 or the 100 largest companies of NASDAQ.

In 2000, Barclays Global Investors boosted the ETF market place with a more complete line of iShares, encompassing almost every aspects of the financial market and emphasizing on education and distribution to outreach long=term investors. Within five years, iShares line surpasses any other ETF in assets in the U.S. and Europe. Barclays Global Investors later on was acquired by BlackRock in 2009.

In 2001, the Vanguard Group was initiated and since then ETFs have gained an unseen popularity because of their flexibility to tailor to any investor' need to follow geographic regions, industrial sectors, commodities, bonds, futures, and any other asset. By now in 2014 there are more than 1,500 ETFs traded in the U.S. with over $1.7 trillion in assets.

Advantages of ETFs compared to Mutual Funds

Diversification. ETFs share this advantage with mutual funds by investing into a large array of companies, thus avoiding company specific risks. However diversification of ETFs should be taken in consideration with their correspondent goals. For example, an ETF that tracks the performance of biotechs may help the investor not to lose money on a specific company that goes bankrupt but cannot shield the investor of biotechs downturn as a whole.

Lower costs. ETFs have typically lower costs than mutual funds because they are not actively managed and simply follow a certain index. Investors are exempt of transaction costs involving with the buying and selling of numerous stocks in the ETF. Advertisement, marketing, distribution, and accounting expenses are also insignificant. Actually, Vanguard Group can charge only as low as $1 per transaction if the investor meets certain conditions of long-term investment.

Buying and selling flexibility. Unlike mutual funds, ETFs are considered stocks, therefore they can be traded as such on the secondary market with the advantages of buying on margin, selling short, options, and the ability of using every kinds of orders such as market order, limit order, stop order, etc... ETFs can be traded instantly during trading day with bid and ask price identical to any stock. Mutual funds shares can be traded only at the close based on their NVA (net value asset).

Tax efficiency. Taxes are collected only if there are gains when selling the stocks. In this case, because all stocks comprising the ETF are almost never sold, very little capital gains are generated. ETFs fund managers don't have to sell securities to meet investors redemption. Therefore, small investors report taxes only on dividends received and capital gains when they sell the ETFs. A long-term investor can see his ETFs egg-nest growing with some sort of tax-deferred feature.

Transparency. As required by SEC, ETFs whether index or actively-managed funds, have transparent portfolios and are priced at frequent intervals throughout trading day, sometimes as fast as 15 seconds each.

Criticism

Some analysts have argued that ETFs are used by many short-term fund managers and their trading expenses diminished returns to investors. Also, ETFs that buy and hold commodities such as previous metals (gold, silver...) may contributed to an unsustainable prices' appreciation of such commodities.

From the perspective of emerging markets, ETFs and leveraged ETFs can pose financial stability risks if equity prices of those countries were to decline for a long period.

A survey from Morgan Stanley shows that the returns of ETFs during the 2009 period missed their target by as much as 1.25% compared to the correspondent indexes due to tracking errors and miscalculated baskets of assets held.

Some critics even claim that ETFs can be and have been used to manipulate market prices, including short selling that may lead to exaggerated sell-offs and leading to financial markets collapses.

Loading