Tìm Kiếm Bài Đã Đăng

|

||

|

||

|

Lời gới thiệu

Bắt đầu từ tháng Giêng 2014, chúng tôi sẽ giới thiệu một loạt bài về Thị Trường Chứng Khoán. Tài liệu này thuộc vào phần đọc thêm trong lớp học về Thị Trường Chứng Khoán do BS Chu Phú Trung, QYHD khoá 19 hướng dẫn dành cho các thành viên của Diễn Đàn Cựu Sinh Viên Quân Y đã tiến hành được vài tuần vừa qua.

Mọi ý kiến đóng góp và câu hỏi xin vui lòng gởi về editors@svqy.org.

Chapter One

The making of the Stock Market

Stock Market History

Once upon a time around 250 years ago, Wall Street was only a dusty road stretched out from the hilltop of the Trinity Church down to the harbor of Manhattan’s East River. The first U.S. Stock Market was created there on the harbor’s docks. During those old times, securities were simply pieces of paper attesting ownership or receipts of goods’ delivery of ships coming from the other side of the Atlantic Ocean, the mainland of Europe. Money paper was still a novelty at that time, so people were more comfortable using silver bars as a universal means of currency. Gold was infrequently used because of its scarcity at the colonies. When needed, silver bars were cut into ½, ¼, or 1/8 called “doubloons” in order to pay for the merchandise. This legacy resulted in the habit of using those denominations for stock trading which lasted till 2001 before converting to the decimal system as we know today.

Obviously, a great deal of people did not want to wait for the ships to arrive, so they might want to trade the receipts for a sum of cash minus the commission’s fees. A new category of entrepreneurs emerges as “stock traders” who were willing to take risks and buy the securities in order to profit when the merchandise arrives safely at the harbor. With the rise of immigration from Europe to the new land of America, the situation became complicated and uncontrollable, which threatened the business.

In the spring of 1792, two most influential persons named John Sutton and Benjamin Jay, along with other 22 individuals, gathered under a button tree in Castle Garden, now called Battery Park, and devised the first agreement of rules, regulations and fees, setting up the foundation of the New York Stock Exchange. They used a building on 22 Wall Street as a location for auctioning securities and called it the Stock Exchange Office.

In a certain sense, this was a very exclusive organization comprising of the most elite New York’s financial community at that time. The system was so efficient that a good number of rules were still used till 1975 before the fees became more flexible and traders were allowed to conclude their transactions outside the exchange. In 1903, the Stock Exchange moved to a bigger location at 18 Broad Street before settling definitely at 11 Wall Street, New York in 1922. In 1971 NYSE was incorporated as a nonprofit organization and moved to the status of for-profit organization on March 7, 2006. On April 4, 2007, NYSE becomes NYSE Euronext, a global marketplace group.

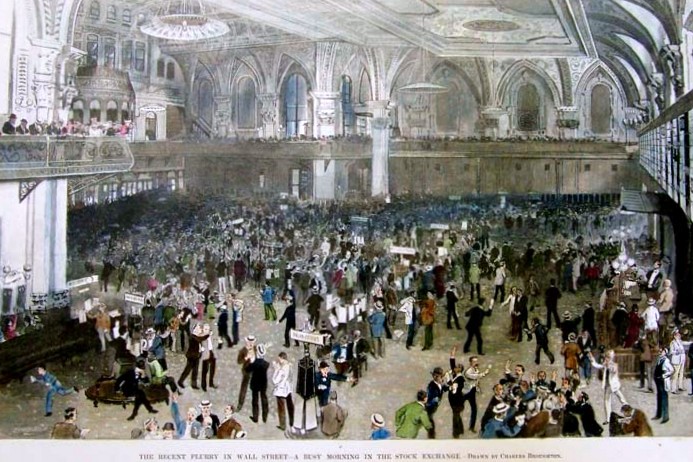

During the Industrial Revolution of the 19th Century, Wall Street activities exploded will all kinds of securities’ transactions and at a certain time, NYSE was overloaded. The exchange decided to keep for itself the best securities and setup higher bars for admission to be listed. The rest which were discarded found their way right at the street curb outside the exchange. The “swap meet market” was called “The Curb” and the traders “Curbstone brokers.”

Nonetheless, in turn, the Curb saw itself a tremendous boom with a surge of activities and moved indoors within the neighborhood houses as trading offices. In order to communicate faster with one another, stockbroker used hand-signals along with nods and winks, sometimes from the curb to the balcony. This way of communication seems to be still in favor nowadays in stock exchanges all around the world.

After over 100 years, curbstone stockbrokers finally decided that it was time for them to have a better home to conduct business. In 1919, they purchased a parcel at 86 Trinity Place at the West End of Wall Street and built a modern establishment that they called the New York Curb Exchange. In 1953, the Curb changed its name to the actual American Stock Exchange (AMEX), the second largest stock exchange after the New York Stock Exchange (NYSE).

Today, the U.S. stock market industry has grown extensively and besides NYSE and AMEX, many other exchanges were created and spread out all around the U.S like Chicago, San Francisco… Worldwide, alongside some very old stock markets such as Paris (Bourse Parisienne) or London, Frankfurt… new exchanges were formed, for instances, Tokyo, Hongkong, Korea, Taipei, Bombay ... The updated list may be seen at the website Stock Exchanges Worldwide links (2009). Generally speaking, wherever an area has needs for financial funding, formation of a stock market is indispensable for the economy’s growth of that area.

Currently, NYSE Euronext holds the status of the largest stock exchange worldwide with approximately 8,500 listed issues, a total global market capitalization of $16.7 trillion (1/3 worldwide) and an average daily trading of more than $150 billion.

However, as history seems to repeat, all major exchanges are unable to satisfy the growing need for funding, thus the appearance of a system of over-the-counter (OTC) stocks listing with new companies where stocks are traded outside official floor-exchanges. After the crash of 1929, US Congress passed the Securities Act of 1933 which established the body of the Securities & Exchange Commission in order to control the activities of stock markets.

In 1934, the National Association of Securities Dealers (NASD) was designed to regulate OTC market which has seen a remarkable explosion of activities. The year of 1971 marks an important milestone of the OTC market with the founding of the National Association of Securities Dealers Automated System (NASDAQ) in which stocks can be traded outside marketplaces through a computerized automated system connecting brokers, traders and market makers. Since its inception, a great deal of OTC stocks has been listed on NASDAQ and the growing number (3,300 stock listings) has made NASDAQ becoming a major part of global stock market with a current market capitalization close to $2 trillion.

Interesting enough, some of the late coming high-tech companies such as Microsoft ($167 billion of market cap), Intel ($89 billion), Cisco ($102 billion), or Google ($89 billion) of the new age have prospered and surpassed old timers like Disney ($36 billion), Ford ($9 billion) or Caterpillar ($19 billion).

From 1982, NASDAQ is divided into two categories of NASDAQ National Market and the NASDAQ Small-Cap Market. During the 1990s, NASDAQ market began to be viewed as a competitor of NYSE. In 1998, NASDAQ merged with the American Stock Exchange and created the NASDAQ-AMEX Market Group. In general, NASDAQ is laden with technology companies, thus has been widely considered as the market of the future.

Then again, a huge number of companies do not meet the minimum requirements of NASDAQ or other floor-based exchanges. They still have the possibility to list and trade their stocks through the system of National Quotations Bureau. They were once printed and listed on pink leaflets affixed on a board, hence the name of “pink sheets” stocks. Around 11,000 pink sheet companies exist today and can be traded with stock symbols ending with a “.PK” suffix.

All securities traded in exchanges, marketplaces, NASDAQ market and OTC markets comprise the so-called Secondary Market in which investors purchase securities and derivatives from other investors, rather than from the issuing companies themselves. The selling of securities from companies comprises the Primary Market which will be explained next.

The Primary Market

The Primary Market refers to the first time securities are issued and sold to the public, also called Initial Public Offering (IPO). In order to issue stocks, the first thing to do for a company is to be incorporated. Take the example of an individual who has a good idea of an original new toy. He can start his business of making the toy as a sole proprietor and register his small enterprise as such.

After a while, his business picks up and he needs more money to take advantage of the opportunity. He may recur to relatives and friends for borrowing and switch to partnership entity. Another option is to borrow money from commercial banks but usually, the loan is rather restricted and the partnership has the responsibility to pay capital and interest during a certain time. If the business explodes and the partnership needs a large funding, it may incorporate the company and sell its stocks to raise the necessary capital through the help of a brokerage firm. The process is called Initial Public Offering or going IPO.

From that time, the company is becoming a public traded company and shareholders are the true owners of the company. Nevertheless, shareholders do not participate on the day-to-day operations of the company and the task is delegated to the board of executives who has the responsibility to report to the board of directors periodically. During the process of incorporation and IPO, the company may ask for a number of authorized stocks but sell only a portion and keeps the rest as authorized but non-issued stocks for later secondary offering.

A traded public company is governed by regulations set by the Securities & Exchanges Commission which consist but not limited to quarterly (10-Q) and annually reports (10-K), accounting transparency and all other regulations to ensure a fair and truthful business. IPO and stock market make up the backbone of a free economy and the essence of capitalism.

Shareholder Wealth Maximization

The primary goal of any public traded company is shareholder wealth maximization, which can be defined as corporate attempts to maximize performance measures such as revenue, profits, margins, or net present. As company investors, shareholders have the legitimate expectation that their investment will be profitable. Investors expect that they would benefit from two ways:

1. To receive dividends. Dividends are distributions of a portion of the company’s profits decided by the Board of Directors to a class of its shareholders. Dividends take usually the form of cash payments, often quoted in terms of the dollar amount for each share and called dividends per share, or as a percentage of the current market price, and called dividend yield. Dividends can also take the form of stocks distribution. Most stable and secure corporations offer dividends to their shareholders, sometimes as high as 10% annually. However, dividends distribution is not mandatory and the company board may suspend or resume the practice at any time. Companies that payout decent dividends commonly have stock prices that do not move much.

2. To profit by stock price appreciation. Stock price appreciation results from the fact that startup or high-growth companies rarely offer dividends but re-invest their earnings to take advantage of market opportunities. As a reminder, a public company does not have the responsibility to distribute all its profits to shareholders and may retain them in order to re-invest into more profitable operations. The compound-interest performance which ensues is the reason that explain why successful companies like Microsoft or Intel can become multi-billion of dollars enterprises in a couple of decades, starting from scraps.

However, what’s in it for the shareholders? In theory, the increased value of the company will be factored into the stock price and will lift it up. For example, an investor buys a stock A at a time that the whole company is valued at $10 million with an outstanding shares number of 1 million. He pays the stock $10 per share. A year later, company A records $10 million of profits and decides to retain all earnings for re-investment purposes. Company A can be fairly valued at $20 million now and the investor would never sell its stock lesser than $20.

As a matter of fact, such a profitable business will attract investors who would bid up the stock price, sometimes at exorbitant levels. On the opposite, when a company seems to face difficulties, its stock price may be beaten down to unreasonable prices, creating opportunities for savvy investors to take advantage of the situation to buy low. A common remark regarding the stock market is that greed and fear are the driving force of the market and mass psychology contributes a crucial part to the volatility of the market.

Bắt đầu từ tháng Giêng 2014, chúng tôi sẽ giới thiệu một loạt bài về Thị Trường Chứng Khoán. Tài liệu này thuộc vào phần đọc thêm trong lớp học về Thị Trường Chứng Khoán do BS Chu Phú Trung, QYHD khoá 19 hướng dẫn dành cho các thành viên của Diễn Đàn Cựu Sinh Viên Quân Y đã tiến hành được vài tuần vừa qua.

Mọi ý kiến đóng góp và câu hỏi xin vui lòng gởi về editors@svqy.org.

Chapter One

The making of the Stock Market

Stock Market History

Once upon a time around 250 years ago, Wall Street was only a dusty road stretched out from the hilltop of the Trinity Church down to the harbor of Manhattan’s East River. The first U.S. Stock Market was created there on the harbor’s docks. During those old times, securities were simply pieces of paper attesting ownership or receipts of goods’ delivery of ships coming from the other side of the Atlantic Ocean, the mainland of Europe. Money paper was still a novelty at that time, so people were more comfortable using silver bars as a universal means of currency. Gold was infrequently used because of its scarcity at the colonies. When needed, silver bars were cut into ½, ¼, or 1/8 called “doubloons” in order to pay for the merchandise. This legacy resulted in the habit of using those denominations for stock trading which lasted till 2001 before converting to the decimal system as we know today.

Obviously, a great deal of people did not want to wait for the ships to arrive, so they might want to trade the receipts for a sum of cash minus the commission’s fees. A new category of entrepreneurs emerges as “stock traders” who were willing to take risks and buy the securities in order to profit when the merchandise arrives safely at the harbor. With the rise of immigration from Europe to the new land of America, the situation became complicated and uncontrollable, which threatened the business.

In the spring of 1792, two most influential persons named John Sutton and Benjamin Jay, along with other 22 individuals, gathered under a button tree in Castle Garden, now called Battery Park, and devised the first agreement of rules, regulations and fees, setting up the foundation of the New York Stock Exchange. They used a building on 22 Wall Street as a location for auctioning securities and called it the Stock Exchange Office.

In a certain sense, this was a very exclusive organization comprising of the most elite New York’s financial community at that time. The system was so efficient that a good number of rules were still used till 1975 before the fees became more flexible and traders were allowed to conclude their transactions outside the exchange. In 1903, the Stock Exchange moved to a bigger location at 18 Broad Street before settling definitely at 11 Wall Street, New York in 1922. In 1971 NYSE was incorporated as a nonprofit organization and moved to the status of for-profit organization on March 7, 2006. On April 4, 2007, NYSE becomes NYSE Euronext, a global marketplace group.

During the Industrial Revolution of the 19th Century, Wall Street activities exploded will all kinds of securities’ transactions and at a certain time, NYSE was overloaded. The exchange decided to keep for itself the best securities and setup higher bars for admission to be listed. The rest which were discarded found their way right at the street curb outside the exchange. The “swap meet market” was called “The Curb” and the traders “Curbstone brokers.”

Nonetheless, in turn, the Curb saw itself a tremendous boom with a surge of activities and moved indoors within the neighborhood houses as trading offices. In order to communicate faster with one another, stockbroker used hand-signals along with nods and winks, sometimes from the curb to the balcony. This way of communication seems to be still in favor nowadays in stock exchanges all around the world.

After over 100 years, curbstone stockbrokers finally decided that it was time for them to have a better home to conduct business. In 1919, they purchased a parcel at 86 Trinity Place at the West End of Wall Street and built a modern establishment that they called the New York Curb Exchange. In 1953, the Curb changed its name to the actual American Stock Exchange (AMEX), the second largest stock exchange after the New York Stock Exchange (NYSE).

Today, the U.S. stock market industry has grown extensively and besides NYSE and AMEX, many other exchanges were created and spread out all around the U.S like Chicago, San Francisco… Worldwide, alongside some very old stock markets such as Paris (Bourse Parisienne) or London, Frankfurt… new exchanges were formed, for instances, Tokyo, Hongkong, Korea, Taipei, Bombay ... The updated list may be seen at the website Stock Exchanges Worldwide links (2009). Generally speaking, wherever an area has needs for financial funding, formation of a stock market is indispensable for the economy’s growth of that area.

Currently, NYSE Euronext holds the status of the largest stock exchange worldwide with approximately 8,500 listed issues, a total global market capitalization of $16.7 trillion (1/3 worldwide) and an average daily trading of more than $150 billion.

However, as history seems to repeat, all major exchanges are unable to satisfy the growing need for funding, thus the appearance of a system of over-the-counter (OTC) stocks listing with new companies where stocks are traded outside official floor-exchanges. After the crash of 1929, US Congress passed the Securities Act of 1933 which established the body of the Securities & Exchange Commission in order to control the activities of stock markets.

In 1934, the National Association of Securities Dealers (NASD) was designed to regulate OTC market which has seen a remarkable explosion of activities. The year of 1971 marks an important milestone of the OTC market with the founding of the National Association of Securities Dealers Automated System (NASDAQ) in which stocks can be traded outside marketplaces through a computerized automated system connecting brokers, traders and market makers. Since its inception, a great deal of OTC stocks has been listed on NASDAQ and the growing number (3,300 stock listings) has made NASDAQ becoming a major part of global stock market with a current market capitalization close to $2 trillion.

Interesting enough, some of the late coming high-tech companies such as Microsoft ($167 billion of market cap), Intel ($89 billion), Cisco ($102 billion), or Google ($89 billion) of the new age have prospered and surpassed old timers like Disney ($36 billion), Ford ($9 billion) or Caterpillar ($19 billion).

From 1982, NASDAQ is divided into two categories of NASDAQ National Market and the NASDAQ Small-Cap Market. During the 1990s, NASDAQ market began to be viewed as a competitor of NYSE. In 1998, NASDAQ merged with the American Stock Exchange and created the NASDAQ-AMEX Market Group. In general, NASDAQ is laden with technology companies, thus has been widely considered as the market of the future.

Then again, a huge number of companies do not meet the minimum requirements of NASDAQ or other floor-based exchanges. They still have the possibility to list and trade their stocks through the system of National Quotations Bureau. They were once printed and listed on pink leaflets affixed on a board, hence the name of “pink sheets” stocks. Around 11,000 pink sheet companies exist today and can be traded with stock symbols ending with a “.PK” suffix.

All securities traded in exchanges, marketplaces, NASDAQ market and OTC markets comprise the so-called Secondary Market in which investors purchase securities and derivatives from other investors, rather than from the issuing companies themselves. The selling of securities from companies comprises the Primary Market which will be explained next.

The Primary Market

The Primary Market refers to the first time securities are issued and sold to the public, also called Initial Public Offering (IPO). In order to issue stocks, the first thing to do for a company is to be incorporated. Take the example of an individual who has a good idea of an original new toy. He can start his business of making the toy as a sole proprietor and register his small enterprise as such.

After a while, his business picks up and he needs more money to take advantage of the opportunity. He may recur to relatives and friends for borrowing and switch to partnership entity. Another option is to borrow money from commercial banks but usually, the loan is rather restricted and the partnership has the responsibility to pay capital and interest during a certain time. If the business explodes and the partnership needs a large funding, it may incorporate the company and sell its stocks to raise the necessary capital through the help of a brokerage firm. The process is called Initial Public Offering or going IPO.

From that time, the company is becoming a public traded company and shareholders are the true owners of the company. Nevertheless, shareholders do not participate on the day-to-day operations of the company and the task is delegated to the board of executives who has the responsibility to report to the board of directors periodically. During the process of incorporation and IPO, the company may ask for a number of authorized stocks but sell only a portion and keeps the rest as authorized but non-issued stocks for later secondary offering.

A traded public company is governed by regulations set by the Securities & Exchanges Commission which consist but not limited to quarterly (10-Q) and annually reports (10-K), accounting transparency and all other regulations to ensure a fair and truthful business. IPO and stock market make up the backbone of a free economy and the essence of capitalism.

Shareholder Wealth Maximization

The primary goal of any public traded company is shareholder wealth maximization, which can be defined as corporate attempts to maximize performance measures such as revenue, profits, margins, or net present. As company investors, shareholders have the legitimate expectation that their investment will be profitable. Investors expect that they would benefit from two ways:

1. To receive dividends. Dividends are distributions of a portion of the company’s profits decided by the Board of Directors to a class of its shareholders. Dividends take usually the form of cash payments, often quoted in terms of the dollar amount for each share and called dividends per share, or as a percentage of the current market price, and called dividend yield. Dividends can also take the form of stocks distribution. Most stable and secure corporations offer dividends to their shareholders, sometimes as high as 10% annually. However, dividends distribution is not mandatory and the company board may suspend or resume the practice at any time. Companies that payout decent dividends commonly have stock prices that do not move much.

2. To profit by stock price appreciation. Stock price appreciation results from the fact that startup or high-growth companies rarely offer dividends but re-invest their earnings to take advantage of market opportunities. As a reminder, a public company does not have the responsibility to distribute all its profits to shareholders and may retain them in order to re-invest into more profitable operations. The compound-interest performance which ensues is the reason that explain why successful companies like Microsoft or Intel can become multi-billion of dollars enterprises in a couple of decades, starting from scraps.

However, what’s in it for the shareholders? In theory, the increased value of the company will be factored into the stock price and will lift it up. For example, an investor buys a stock A at a time that the whole company is valued at $10 million with an outstanding shares number of 1 million. He pays the stock $10 per share. A year later, company A records $10 million of profits and decides to retain all earnings for re-investment purposes. Company A can be fairly valued at $20 million now and the investor would never sell its stock lesser than $20.

As a matter of fact, such a profitable business will attract investors who would bid up the stock price, sometimes at exorbitant levels. On the opposite, when a company seems to face difficulties, its stock price may be beaten down to unreasonable prices, creating opportunities for savvy investors to take advantage of the situation to buy low. A common remark regarding the stock market is that greed and fear are the driving force of the market and mass psychology contributes a crucial part to the volatility of the market.

Diễn Đàn Cựu Sinh Viên Quân Y

© 2014

© 2014

Loading