Tìm Kiếm Bài Đã Đăng

|

||

|

||

|

Chapter Two

How does the Stock Market work?

The most commonly asked question that an investor likes to know is what happens when a stock is bought or sold? To better understand the process, we may consider the stock market as an auction-based marketplace with the only difference that the goods traded are securities instead of merchandises.

Therefore, it needs the presence of middlemen who have cash to buy the stocks that investors want to sell and an inventory of stocks to sell when investors want to buy the stocks. Those middlemen range from the stockbrokers representing their clients to the market makers and the specialists at the NYSE. They offer a bid price to buy stocks and a higher ask price to sell stocks. Those prices are always linked with volumes available and once the number is met, they might raise or lower the prices according with demand, the more the demand, the higher the prices and vice versa. The difference between bid price and ask price is called spread and the main source of profits of middlemen, besides some commission fees. During volatile situations or unavailability of stocks, the spread may be very significant.

The role of the National Association of Securities Dealers (NASD) and the Securities & Exchange Commission is to regulate a fair and normal operational process of stocks trading. The NASD is responsible for the registration, education, testing, and examination of member firms and their employees. Furthermore, it oversees and regulates market-making activities and trading practices in securities, including those that are listed on the NASDAQ Stock Market, the American Stock Exchange and those that are not listed on any exchange. Under current federal securities laws, all individuals and organizations engaged in the business of securities trading should have the responsibility for regulating their own behavior through Self Regulatory Organizations (SROs) operating under the oversight of the SEC. These SROs include all exchanges, the NASD, and the Municipal Securities Rulemaking Board (MSRB). The role of the SEC, an independent agency of he US government is to ensure that the securities markets are operating in a fair and orderly manner and to supervise the disclosure of company’ material information so that investors can make informed investment decisions.

The NYSE specialist system

The NYSE is perhaps the only exchange worldwide that uses the system of specialists for stocks quotation. In a nutshell, when an order, either to sell or to buy, arrives at the exchange, the floor broker brings the order to the corresponding trading pit and requests a quote from the specialist. The latter would gives the quote with bid and ask prices, and the amount available. Then the broker can fill the order himself or leaves the order (for example, a limit order that he cannot fulfill) to the specialist who records it into his book. Therefore, the specialist possesses a list of sell and buy orders that he cannot match yet. Now he may use his own account to offer bid and ask prices which are inside the range of difference between the actual bid and ask prices. However, he is allowed to buy only when the price is on a down-tick, meaning the stock price is dropping, and to sell only when the price is on an up-stick. The rationale of the practice is that by doing so, the specialist can serve as a dumper to support beating down prices and to cool off soaring prices, thus improving an orderly stock trading.

Some of the most famous specialist firms are known as LaBranche & Co, Fleet Specialist, Bear Wagner Specialists, and Spear, Leads & Kellogg which have representatives sitting on the Board of NYSE. In fact, about one fourth of all transactions in NYSE involve the specialists’ intervention with their own capital.

Recently, criticism mounts regarding the practice of specialists who play a dual role which is fraught with conflicts of interest. No doubt that they have the major advantage of “front-running” opportunities and may give themselves the best deals possible at the expenses of other brokers and clients. In fact, some specialist firms have been fined by the SEC for unethical practices. In light of the fierce competition by other exchanges and in particular the automated system of NASDAQ, NYSE decides to move to an Hybrid Market in which new trading systems and new technologies are incorporated alongside with the traditional specialist system. In March 2006, the SEC approves NYSE Hybrid Market Proposal. Nonetheless, the latter system seems not to work as efficiently as expected. In June 2008, The NYSE proposes some rules that would eliminate the traditional specialist system which has been in practice for more than 200 years and replaces them by designated market makers (DMMs). The key change is that specialists are no longer able to have the first look at electronic orders before they are displayed to the public. However, they have more freedom to trade other securities such as derivatives and contribute actively to the market liquidity.

The NASDAQ system of trading

Unlike the NYSE, the NASDAQ stock market is completely computerized and its system comprises of a network linking geographically dispersed brokerage firms and investment banks. Most of them serve as markets makers for NASDAQ-listed stocks, maintaining inventories of cash and selected stocks and investors can always buy or sell their shares by a click of a mouse. The most relevant aspect of NASDAQ is the absence of a physical exchange or marketplace. All transactions are conducted through a network of computers worldwide. In general, NASDAQ system of trading comprises of three components: (1) the interface or the means that brokers, dealers and market makers can access to the system and auction their stocks or post their intentions to buy a certain amount of selected stocks, (2) the matching engine or the system of computers that connects buyers and sellers when their prices match, and (3) the quotes services or the system which reveals the bid and ask prices that NASDAQ provides.

Quotes through NASDAQ are available in three levels:

1. Level-one which tells the current highest bid and the lowest offer of a particular stock, along with the volume or amount available. Individual investors are always provided with level-one quotation whenever seeking the price of a certain quote. A more sophisticated feature of level-one quotation is the streamlined table of quotation which records in real time all transactions of a stock as they are happening, along with the volume.

2. Level-two which shows all public quotes of market makers in two columns buys and sells and recently executed orders. This feature allows the viewer to get a general picture of how a particular stock is trading and the strength or weakness within an issue at each level price. In many circumstances, traders can use the level-two information to ascertain support and resistance levels as a way to route their orders. Most of major brokerage firms offer their clients the access to level-two quotation.

3. Level-three which is exclusively available to dealers and market makers to enter their quotes and to execute orders. The majority of investors cannot access this level-three system of trading.

Laws that govern the stock market

After the crash of the stock market of 1929, Congress passed the first Securities Act of 1933 referred to as the “truth in securities” law with two basic objectives: (1) to require that public companies to reveal all pertinent financial and other significant information concerning securities, (2) to prohibit deceit, misrepresentations and other fraudulent activities concerning the sale of securities.

The following year, Congress passed the Securities Exchange Act of 1934 creating the Securities and Exchange Commission (SEC) which regulates and oversees all aspects of the securities industry. Furthermore, the various stock exchanges such as the NYSE and the AMEX are SROs. The NASD, which operates the NASDAQ, is also an SRO.

In 1939, Congress adopted the Trust Indenture Act of 1939 regulating the sale of debt securities such as bonds, debentures, and notes, to the public.

The Investment Company Act of 1940 regulates the organization of companies, encompassing mutual funds, which engage primarily in trading of securities, investing and reinvesting securities. The focus of this Act is to require investing company to disclose fully all relevant information regarding the company objectives, structure and operations.

The same year, Congress passed the Investment Advisers Act of 1940 regulating the operations of investment advisers. The Act requires that firms or individuals who engage in the business of investing advising for compensation must register with the SEC and to conform to regulations designed to protect investors. This Act was amended in 1996 and generally, only advisers who have at least $25 million of assets under management must register with the SEC.

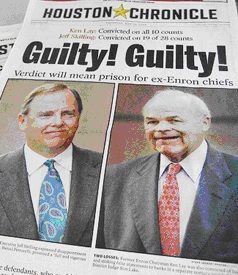

The Sarbanes-Oxley Act (SOX) came into force in July 2002 and mandated changes in corporate governance and financial practice for companies. This measure was passed to strengthen corporate governance in order to prevent future failures like Enron or Tyco. The SOX is arranged in 11 “titles” and the most important sections are considered to be 302, 401, 404, 409, 802, and 906.

A provision requires that the executives will have “to disgorge any profits from bonuses and stocks sales during the 12-month period that follows a financial report that is subsequently restated because of “misconduct.” (Chew & Gillian, 2004).This provision would discourage executives to sell stocks while still in office. Any executive stocks selling will now have to be reported within two days instead of the current 10 days, which will make those selling more visible to the public.

Another provision “requires more detailed disclosure of off-balance-sheet financings and special purpose entities, making more difficult for companies to manipulate their financial statements in a way that boost the current stock price.” (Chew & Gillian, 2004).

SOX includes a number of provisions aimed to improve board monitoring by the creation of the Public Company Accounting Oversight Board. (FindLaw.com, 2008).

Notably, “SOX increases management’s and the board’s responsibility for financial reporting, and the penalties for misreporting.” (Chew & Gillian, 2004).

Diễn Đàn Cựu Sinh Viên Quân Y

© 2014

© 2014

Loading