Tìm Kiếm Bài Đã Đăng

|

||

|

||

|

Chapter Three

Trading Stocks

An investor has two ways to get involved into the stock market, through a stockbroker who acts as a full-commission broker or the do-it-yourself way through a discount brokerage firm. The latter can be done on-line.

Full commission broker

The investor may search the Internet or look-up newspapers advertisements to find a full commission broker or a financial advisor and setup an appointment to discuss the matter with an agent. Legally, the agent should know about the investor’s financial status in order to propose a suitable investment program. It would be unethical or even against the law if the broker is aware of his client’s financial difficulties and still advises risky investments.

After realizing that the client has met the minimum conditions, the broker may suggest some investments, either to buy stocks, mutual funds or bonds, or a mixture of the investing vehicles called a portfolio. Also called full-service broker, the financial advisor offers a variety of services, including personal advices, tax tips, retirement planning, and other investment product such as derivatives and insurance means. Full commission brokerage services are expensive, with commission fees as high as $150 a trade and not quite suitable for small investors. Because the broker’s fee is based on the number of transactions and not on performance, this may lead to a situation called “churning” or excessive trading which is against the industry regulations. By law, a broker cannot accept any gifts from his clients which worth more than $100 over a one-year period.

Usually, a couple of thousands of dollars are enough to start an investing account called a cash account and the investor is able to buy securities to the limit of the cash account. Any residual amount will be put into a money market account which bears some interest rate.

Over time, the bond between the investor and the full-service broker may become a long lasting relationship, especially when the broker has proven to be a trustworthy companion for the investor financial health. Many well-known full-service brokerage firms are available for investors who are seeking for the best advices regarding investing, to name a few: Merrill Lynch, Morgan Stanley Dean Witter, or Salomon Smith & Barney etc…

Discount broker

For most small investors, a discount brokerage service is appropriate enough to start investing. Discount brokerage firms do not provide investment advices and charge a minimum commission fee as low as $3 per trade but the norm is about $10 for a maximum of 5,000 shares per trade. Charles Schwab and TD Ameritrade are among the best-known discount brokerages which services are quite efficient and reliable. Most of the transactions can be performed on-line with a click of the mouse, although the investor may also use the automated phone system to put his orders. With the increasing use of the Internet, many discount brokerages provide a host of high quality services such as level II quote system, deep investment research, and any other investment tools which may keep the investors fully informed of the macro and micro economics of his investment portfolio.

Long position

The easiest and most common way of investing is to buy a stock and to hold it over a period. The position is called a long position and the investor’s act of buying a stock is referred to “go long” on a stock. When the stock is held over one-year time frame, the position is called long-term, which may have some tax advantages when selling with a profit. If sold within a year, the result is called short-term gain or loss. Investors who trade stocks a very short time, days or even hours are described as day-traders who want to profit from the market volatility during the trading day. Nonetheless, this way of investing is regarded mostly as gambling and inappropriate for a serious investor.

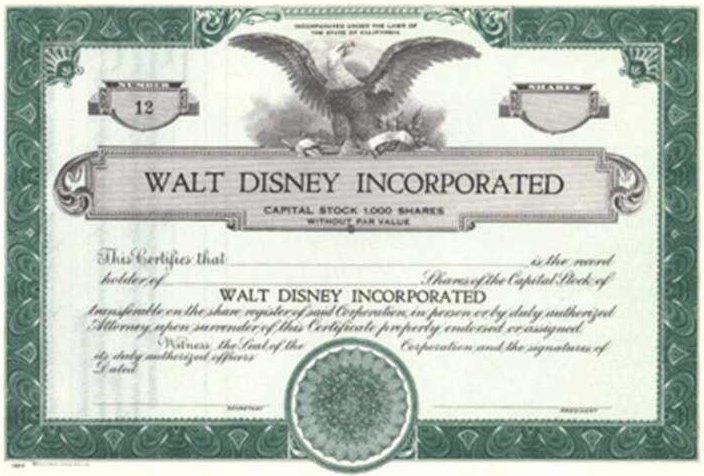

In theory, when the investor buys a stock, he may request a stock certificate attesting ownership along with the number and price of shares after paying a certain fee. Some brokerages such as TD Ameritrade offer to deliver certificates with no charge up to four certificates per calendar year. Obviously, possessing a stock certificate in hand may bring some good feelings for the owner but may also undergo the disadvantage of having to mail the certificate back to the brokerage in order to sell it. The delay could cause wrong market timing. Most investors prefer the way of putting ownership “in street name,” meaning the name that appears on the certificate is of the broker. That way has the advantage of instant trade instantly through on-line. In fact, even the broker does not hold the physical document, but rather an electronic form in the computer system to facilitate transactions.

Short position

Sometimes, the investor may be bearish about the stock market and thinks that prices could go down further. He may take advantage of the situation by “go short,” or to sell the stock that he does not own. The brokerage firm will “lend” the stock that is holding in street name and sell it for the investor. The position is called a short position. Eventually, the investor must cover his short position to cash out the profit when the price is down enough, or forced to cover it when his collateral buying power is depleted because the stock price rises against his expectation. In order to do that, the investor should have a margin account which requires some requirements regarding experience, financial status and the stock availability for short position. Although short position may be used as a means of hedging, the procedure is mostly considered very risky because of unlimited potential losses while all the investor can profit is the selling price of the stock if the company would go bankrupt.

Margin account

With a margin account, the investor may borrow cash from the brokerage firm in order to leverage his buying power. As a norm, to start, the investor may borrow an amount up to the limit of his initial investment, either cash or cash equivalent. The latter is considered collaterals to the amount borrowed. The margin interest rate is actually around 6-7%.

An example:

An investor has $10,000 cash in his account. He can borrow up to $10,000 more from the brokerage, thus possesses $20,000 buying power. Now he decides to buy ABC stock priced at $10/share. Therefore he can buy 2,000 ABS shares.

Let’s suppose that ABC rises to $15. The investment value rises to $30,000 in which $10,000 is debt and the investor’s equity is now $20,000 or a 100% gain, compared to only 50% if he did not buy on margin. Because the investor’s equity has jumped up, he may borrow $10,000 more to leverage even further. If everything happens according to expectations, profits may grow exponentially but the opposite could happen similarly.

Now let’s suppose that ABC drops to $7.5, the mark-to-market value of the 2,000 shares would decrease to $15,000 in which debt still stands at $10,000 and the investor’s equity drops to $5,000 or 50% loss instead of only 25% if he did not buy on margin. Now the thing is because the investor’s equity is decreasing to 1/3 of the total investment value, he faces a situation called “margin call”. The brokerage will require the investor to put more collateral or it will be forced to sell enough shares to maintain the ratio of 1/3 equity. If the stock price drops even further in the neighborhood of 50%, the investor may lose all his initial investment.

The above example illustrates clearly the danger of buying on margin and sadly, financial crisis with securities losing more than 50% of their values have wiped out a huge amount of margin accounts.

Options

Besides stock shares, a host of other means of investing relating to stock shares exists, such as options trading, leaps, warrants, convertibles, to list a few. However, the scope of this book will refer only some of the aspects of options trading. In general, there are two types of options, call options and put options. Every option transaction has two sides, the buying side and the seller side. The buyer is said to have a long position while the seller is said to have a short position. Transactions are conducted through options market makers who match buyers and sellers or for their own accounts.

Call options

A call option is a right, but not an obligation, to buy a certain stock at a specified price called strike price at a predetermined due date. Usually, the due date is set monthly and on the third Friday of the month. Recently many stocks have due date set weekly. Long options with time frame of more than a year are called leaps. A whole range of different strike prices and expiration dates are available for options traders. The option premium (or option price) is determined by a complicated formula taking account of the time frame, the strike price, the volatility of the stock and all relevant market conditions. Two components make up the premium pricing: the time value and the intrinsic value. The longer the time, the higher the premium and vice versa. The intrinsic value is the difference between the market price of the stock and the strike price. When the strike price is below the market price, the option is called in-the-money, meaning the option has already some true value in it. If the strike price is above the market price, the option is said out-of-money, meaning the whole premium consists of time value only. The seller of the call is known as the call writer and has the obligation to sell the stock to the buyer according to the terms of the option contract. A contract is set at a minimum of 100 shares.

Let’s take the example of the investor who has $10,000 and company ABC which stock is priced at $100. The investor could buy 100 shares of ABC, or buy ABC’s options instead. Let’s suppose that the call option for ABC at 100 (strike price) and 3 months (expiration date) is listed for $5. The investor may buy a contract of call option for $500. In the event of ABC rising above 100, he may profit as if he has bought 100 shares of ABC. In case that ABC stays below 100, he would lose all his $500, but no more than that. Now, if the investor spends all his $10,000 to buy options, he can “control” 2,000 shares of ABC and leverages his investment. Obviously, he would make much more money if the stock rises above 100 + 5 (premium) but the opposite is also true, he can lose all his $10,000 if the stock stays below 100.

Put options

A put option is a right, but not the obligation, to sell a certain stock at a specified price called strike price at a predetermined due date. On the other side, the put writer has the obligation to buy the stock to honor the contract. The put buyer does not need to physically own the stock before selling it. Usually, before or on expiration date, the contract’s terms are settled with cash between option buyer and seller if the put buyer has any profit. In the case the market goes against the buyer expectation, the latter may let the put option unexercised and loses his premium.

Let’s go back to the example above. This time, instead of buy call options, the investor may think that the stock will decrease in value. In this case, he may buy a put option of ABC with the strike price of 100 and 3 months of expiration date. Let’s suppose that the premium is priced at $5. Then the investor may buy a put option contract and pays $500 to control 100 ABC shares. In case the stock indeed drops to less than $100 at or before expiration, he may exercise his put and profits from the proceeds. If the opposite happens, all he can lose is the $500.

Why use options?

From the above examples, a call option buyer profits in a bull market and a put option buyer profits during a bear market, the main difference between buying a stock and an option is the high degree of leverage of investment. Calls and puts, or a combination of both, or used with positions of the underlying stocks can provide a host of investment techniques for the purpose of leveraging an investment, protecting and hedging a portfolio, or generating a steady income from underlying relatively safe stocks:

· Calls and puts used alone can be a means of leverage during volatile market conditions.

·Puts used in combination with positions in underlying stocks is a way to hedge the portfolio.

·To write covered calls from positions in underlying stocks is a conservative technique to generate a steady income.

Types of orders

Typically, an order for stock trading should convey enough information for the stockbroker to be able to fill without error. The format of orders may differ slightly from firm to firm but in general, it encompasses six necessary points:

1. Order to buy, sell (in case of long position) or sell short, and buy to cover (in case of short position).

2. Number of shares. The number of shares must be specified. Some stocks are traded on lots comprising of 100 shares each only. An amount of stock fewer than 100 shares is called odd-lot.

3. Ticker Symbol. Each company is represented by a symbol that can be looked up through a web tool that goes with the quote. Formerly, a stock listed on NYSE and AMEX has only from 1 - 3 letters such as C: Citigroup Inc., BA: Boeing Company, or AXP: American Express Company and a stock listed on NASDAQ has 4 - 5 letters such as CSCO: Cisco Systems Inc. or MSFT: Microsoft Corporation. Recently in July 2007, the SEC has approved a rule change allowing companies that move from NYSE to the NASDAQ to retain their letter symbols. DTV (Direct TV Group) is an example, as well as CA (Computer Associates, Inc.).

4. Order type. Three most common order types are available for trading: market order, limit order and stop order. A combination of the above types results to stop market order and stop limit order.

Market order is used when the investor wants an immediate execution at the best price possible, either to buy or to sell. This is the most common type of order and has the advantage of being nearly always executed since no price is being specified. However, the disadvantage is that the investor may get a poor price, especially when the stock spread is too wide due to market uncertainties or when the stock is highly volatile. Prices may change drastically when the market order enter the exchanges for trading.

Limit order. To circumvent the disadvantage of a market order, the investor may use a limit order which specifies the price limit that he wants the order to be executed. A buy limit order indicates the price that the investor desires to buy the stock at. This price is usually lower than the current stock price because a higher or at the current ask price will result to an immediate execution like a market order. For example, ABC asking price is currently $100. An investor may wish to buy the stock at $95. Therefore, he can put a buy limit order at $95 for a time period of a day (default) or “good-till-canceled” (which varies from 30 to 90 days). Anytime during the specified time period that the stock price drops to $95, the order will be filled. On the other hand, a sell limit order states the price that the investor wants to sell his position at. This price is usually higher than the current stock price. Using the same example, an investor who own ABC at $100 may wish to sell his position at $110. Hence, he can place a sell limit order at $110 which will be active for a specified time period.

Stop order. Stop orders can be sell stop order or buy stop order.

A sell stop order is a way to sell automatically a position when it drops to a specified price. For example, an investor is holding ABC at $100 and does not want to lose more than 10% of its value. Thus, he may place a sell stop order at $90 “good-til-cancelled” (GTC). Anytime the stock drops to $90, it will trigger a market order and the stock will be sold. This is also a way to conserve profits by raising the sell stop order as the stock price increases in value.

A buy stop order is used in case of going short. The investor may be aware that losses when going short can be unlimited when the stock price rises, so he can limit the damages by placing a buy stop order on a short position. When the stock reaches the predetermined price, the buy stop order becomes a market buy order and the short position will be covered.

Stop limit order. Overall, a stop limit order is similar to a stop order with the only difference that when the order is triggered, it becomes a limit order instead of a market order in case of a stop order. This added feature aims to prevent a too quick execution of the order which may not be suitable for the investor’s desires. For example, overnight, because of breaking news, a stock may open too low or too high and a regular stop order may result to an execution that is against the investor’s anticipation.

5. Price. Except for a market order, any other types of orders must have a price to be valid.

6. Time limit. Any order has a time limit and the default is usually set at a day time range, meaning during the working hours which the market is operating. A “good-til-cancelled” (GTC) may last from 30 to 90 days depending on firms. Other time limits may consist of a day order + extended hours, either before hours or after hours, or both and the same can be applied to a GTC order + extended hours.

Other specifications. Some other specifications of minor importance may come with an order such as All-or-None (AON), meaning that the order must be carried out as a whole and not partially. The Fill-or-Kill (FOK) specifies that the transaction must be filled immediately and in its entirely or it should be canceled (killed).

Trading Stocks

An investor has two ways to get involved into the stock market, through a stockbroker who acts as a full-commission broker or the do-it-yourself way through a discount brokerage firm. The latter can be done on-line.

Full commission broker

The investor may search the Internet or look-up newspapers advertisements to find a full commission broker or a financial advisor and setup an appointment to discuss the matter with an agent. Legally, the agent should know about the investor’s financial status in order to propose a suitable investment program. It would be unethical or even against the law if the broker is aware of his client’s financial difficulties and still advises risky investments.

After realizing that the client has met the minimum conditions, the broker may suggest some investments, either to buy stocks, mutual funds or bonds, or a mixture of the investing vehicles called a portfolio. Also called full-service broker, the financial advisor offers a variety of services, including personal advices, tax tips, retirement planning, and other investment product such as derivatives and insurance means. Full commission brokerage services are expensive, with commission fees as high as $150 a trade and not quite suitable for small investors. Because the broker’s fee is based on the number of transactions and not on performance, this may lead to a situation called “churning” or excessive trading which is against the industry regulations. By law, a broker cannot accept any gifts from his clients which worth more than $100 over a one-year period.

Usually, a couple of thousands of dollars are enough to start an investing account called a cash account and the investor is able to buy securities to the limit of the cash account. Any residual amount will be put into a money market account which bears some interest rate.

Over time, the bond between the investor and the full-service broker may become a long lasting relationship, especially when the broker has proven to be a trustworthy companion for the investor financial health. Many well-known full-service brokerage firms are available for investors who are seeking for the best advices regarding investing, to name a few: Merrill Lynch, Morgan Stanley Dean Witter, or Salomon Smith & Barney etc…

Discount broker

For most small investors, a discount brokerage service is appropriate enough to start investing. Discount brokerage firms do not provide investment advices and charge a minimum commission fee as low as $3 per trade but the norm is about $10 for a maximum of 5,000 shares per trade. Charles Schwab and TD Ameritrade are among the best-known discount brokerages which services are quite efficient and reliable. Most of the transactions can be performed on-line with a click of the mouse, although the investor may also use the automated phone system to put his orders. With the increasing use of the Internet, many discount brokerages provide a host of high quality services such as level II quote system, deep investment research, and any other investment tools which may keep the investors fully informed of the macro and micro economics of his investment portfolio.

Long position

The easiest and most common way of investing is to buy a stock and to hold it over a period. The position is called a long position and the investor’s act of buying a stock is referred to “go long” on a stock. When the stock is held over one-year time frame, the position is called long-term, which may have some tax advantages when selling with a profit. If sold within a year, the result is called short-term gain or loss. Investors who trade stocks a very short time, days or even hours are described as day-traders who want to profit from the market volatility during the trading day. Nonetheless, this way of investing is regarded mostly as gambling and inappropriate for a serious investor.

In theory, when the investor buys a stock, he may request a stock certificate attesting ownership along with the number and price of shares after paying a certain fee. Some brokerages such as TD Ameritrade offer to deliver certificates with no charge up to four certificates per calendar year. Obviously, possessing a stock certificate in hand may bring some good feelings for the owner but may also undergo the disadvantage of having to mail the certificate back to the brokerage in order to sell it. The delay could cause wrong market timing. Most investors prefer the way of putting ownership “in street name,” meaning the name that appears on the certificate is of the broker. That way has the advantage of instant trade instantly through on-line. In fact, even the broker does not hold the physical document, but rather an electronic form in the computer system to facilitate transactions.

Short position

Sometimes, the investor may be bearish about the stock market and thinks that prices could go down further. He may take advantage of the situation by “go short,” or to sell the stock that he does not own. The brokerage firm will “lend” the stock that is holding in street name and sell it for the investor. The position is called a short position. Eventually, the investor must cover his short position to cash out the profit when the price is down enough, or forced to cover it when his collateral buying power is depleted because the stock price rises against his expectation. In order to do that, the investor should have a margin account which requires some requirements regarding experience, financial status and the stock availability for short position. Although short position may be used as a means of hedging, the procedure is mostly considered very risky because of unlimited potential losses while all the investor can profit is the selling price of the stock if the company would go bankrupt.

Margin account

With a margin account, the investor may borrow cash from the brokerage firm in order to leverage his buying power. As a norm, to start, the investor may borrow an amount up to the limit of his initial investment, either cash or cash equivalent. The latter is considered collaterals to the amount borrowed. The margin interest rate is actually around 6-7%.

An example:

An investor has $10,000 cash in his account. He can borrow up to $10,000 more from the brokerage, thus possesses $20,000 buying power. Now he decides to buy ABC stock priced at $10/share. Therefore he can buy 2,000 ABS shares.

Let’s suppose that ABC rises to $15. The investment value rises to $30,000 in which $10,000 is debt and the investor’s equity is now $20,000 or a 100% gain, compared to only 50% if he did not buy on margin. Because the investor’s equity has jumped up, he may borrow $10,000 more to leverage even further. If everything happens according to expectations, profits may grow exponentially but the opposite could happen similarly.

Now let’s suppose that ABC drops to $7.5, the mark-to-market value of the 2,000 shares would decrease to $15,000 in which debt still stands at $10,000 and the investor’s equity drops to $5,000 or 50% loss instead of only 25% if he did not buy on margin. Now the thing is because the investor’s equity is decreasing to 1/3 of the total investment value, he faces a situation called “margin call”. The brokerage will require the investor to put more collateral or it will be forced to sell enough shares to maintain the ratio of 1/3 equity. If the stock price drops even further in the neighborhood of 50%, the investor may lose all his initial investment.

The above example illustrates clearly the danger of buying on margin and sadly, financial crisis with securities losing more than 50% of their values have wiped out a huge amount of margin accounts.

Options

Besides stock shares, a host of other means of investing relating to stock shares exists, such as options trading, leaps, warrants, convertibles, to list a few. However, the scope of this book will refer only some of the aspects of options trading. In general, there are two types of options, call options and put options. Every option transaction has two sides, the buying side and the seller side. The buyer is said to have a long position while the seller is said to have a short position. Transactions are conducted through options market makers who match buyers and sellers or for their own accounts.

Call options

A call option is a right, but not an obligation, to buy a certain stock at a specified price called strike price at a predetermined due date. Usually, the due date is set monthly and on the third Friday of the month. Recently many stocks have due date set weekly. Long options with time frame of more than a year are called leaps. A whole range of different strike prices and expiration dates are available for options traders. The option premium (or option price) is determined by a complicated formula taking account of the time frame, the strike price, the volatility of the stock and all relevant market conditions. Two components make up the premium pricing: the time value and the intrinsic value. The longer the time, the higher the premium and vice versa. The intrinsic value is the difference between the market price of the stock and the strike price. When the strike price is below the market price, the option is called in-the-money, meaning the option has already some true value in it. If the strike price is above the market price, the option is said out-of-money, meaning the whole premium consists of time value only. The seller of the call is known as the call writer and has the obligation to sell the stock to the buyer according to the terms of the option contract. A contract is set at a minimum of 100 shares.

Let’s take the example of the investor who has $10,000 and company ABC which stock is priced at $100. The investor could buy 100 shares of ABC, or buy ABC’s options instead. Let’s suppose that the call option for ABC at 100 (strike price) and 3 months (expiration date) is listed for $5. The investor may buy a contract of call option for $500. In the event of ABC rising above 100, he may profit as if he has bought 100 shares of ABC. In case that ABC stays below 100, he would lose all his $500, but no more than that. Now, if the investor spends all his $10,000 to buy options, he can “control” 2,000 shares of ABC and leverages his investment. Obviously, he would make much more money if the stock rises above 100 + 5 (premium) but the opposite is also true, he can lose all his $10,000 if the stock stays below 100.

Put options

A put option is a right, but not the obligation, to sell a certain stock at a specified price called strike price at a predetermined due date. On the other side, the put writer has the obligation to buy the stock to honor the contract. The put buyer does not need to physically own the stock before selling it. Usually, before or on expiration date, the contract’s terms are settled with cash between option buyer and seller if the put buyer has any profit. In the case the market goes against the buyer expectation, the latter may let the put option unexercised and loses his premium.

Let’s go back to the example above. This time, instead of buy call options, the investor may think that the stock will decrease in value. In this case, he may buy a put option of ABC with the strike price of 100 and 3 months of expiration date. Let’s suppose that the premium is priced at $5. Then the investor may buy a put option contract and pays $500 to control 100 ABC shares. In case the stock indeed drops to less than $100 at or before expiration, he may exercise his put and profits from the proceeds. If the opposite happens, all he can lose is the $500.

Why use options?

From the above examples, a call option buyer profits in a bull market and a put option buyer profits during a bear market, the main difference between buying a stock and an option is the high degree of leverage of investment. Calls and puts, or a combination of both, or used with positions of the underlying stocks can provide a host of investment techniques for the purpose of leveraging an investment, protecting and hedging a portfolio, or generating a steady income from underlying relatively safe stocks:

· Calls and puts used alone can be a means of leverage during volatile market conditions.

·Puts used in combination with positions in underlying stocks is a way to hedge the portfolio.

·To write covered calls from positions in underlying stocks is a conservative technique to generate a steady income.

Types of orders

Typically, an order for stock trading should convey enough information for the stockbroker to be able to fill without error. The format of orders may differ slightly from firm to firm but in general, it encompasses six necessary points:

1. Order to buy, sell (in case of long position) or sell short, and buy to cover (in case of short position).

2. Number of shares. The number of shares must be specified. Some stocks are traded on lots comprising of 100 shares each only. An amount of stock fewer than 100 shares is called odd-lot.

3. Ticker Symbol. Each company is represented by a symbol that can be looked up through a web tool that goes with the quote. Formerly, a stock listed on NYSE and AMEX has only from 1 - 3 letters such as C: Citigroup Inc., BA: Boeing Company, or AXP: American Express Company and a stock listed on NASDAQ has 4 - 5 letters such as CSCO: Cisco Systems Inc. or MSFT: Microsoft Corporation. Recently in July 2007, the SEC has approved a rule change allowing companies that move from NYSE to the NASDAQ to retain their letter symbols. DTV (Direct TV Group) is an example, as well as CA (Computer Associates, Inc.).

4. Order type. Three most common order types are available for trading: market order, limit order and stop order. A combination of the above types results to stop market order and stop limit order.

Market order is used when the investor wants an immediate execution at the best price possible, either to buy or to sell. This is the most common type of order and has the advantage of being nearly always executed since no price is being specified. However, the disadvantage is that the investor may get a poor price, especially when the stock spread is too wide due to market uncertainties or when the stock is highly volatile. Prices may change drastically when the market order enter the exchanges for trading.

Limit order. To circumvent the disadvantage of a market order, the investor may use a limit order which specifies the price limit that he wants the order to be executed. A buy limit order indicates the price that the investor desires to buy the stock at. This price is usually lower than the current stock price because a higher or at the current ask price will result to an immediate execution like a market order. For example, ABC asking price is currently $100. An investor may wish to buy the stock at $95. Therefore, he can put a buy limit order at $95 for a time period of a day (default) or “good-till-canceled” (which varies from 30 to 90 days). Anytime during the specified time period that the stock price drops to $95, the order will be filled. On the other hand, a sell limit order states the price that the investor wants to sell his position at. This price is usually higher than the current stock price. Using the same example, an investor who own ABC at $100 may wish to sell his position at $110. Hence, he can place a sell limit order at $110 which will be active for a specified time period.

Stop order. Stop orders can be sell stop order or buy stop order.

A sell stop order is a way to sell automatically a position when it drops to a specified price. For example, an investor is holding ABC at $100 and does not want to lose more than 10% of its value. Thus, he may place a sell stop order at $90 “good-til-cancelled” (GTC). Anytime the stock drops to $90, it will trigger a market order and the stock will be sold. This is also a way to conserve profits by raising the sell stop order as the stock price increases in value.

A buy stop order is used in case of going short. The investor may be aware that losses when going short can be unlimited when the stock price rises, so he can limit the damages by placing a buy stop order on a short position. When the stock reaches the predetermined price, the buy stop order becomes a market buy order and the short position will be covered.

Stop limit order. Overall, a stop limit order is similar to a stop order with the only difference that when the order is triggered, it becomes a limit order instead of a market order in case of a stop order. This added feature aims to prevent a too quick execution of the order which may not be suitable for the investor’s desires. For example, overnight, because of breaking news, a stock may open too low or too high and a regular stop order may result to an execution that is against the investor’s anticipation.

5. Price. Except for a market order, any other types of orders must have a price to be valid.

6. Time limit. Any order has a time limit and the default is usually set at a day time range, meaning during the working hours which the market is operating. A “good-til-cancelled” (GTC) may last from 30 to 90 days depending on firms. Other time limits may consist of a day order + extended hours, either before hours or after hours, or both and the same can be applied to a GTC order + extended hours.

Other specifications. Some other specifications of minor importance may come with an order such as All-or-None (AON), meaning that the order must be carried out as a whole and not partially. The Fill-or-Kill (FOK) specifies that the transaction must be filled immediately and in its entirely or it should be canceled (killed).

Diễn Đàn Cựu Sinh Viên Quân Y

© 2014

© 2014

Loading