Tìm Kiếm Bài Đã Đăng

Diễn Đàn Cựu Sinh Viên Quân Y

© 2014

© 2014

Chapter Five

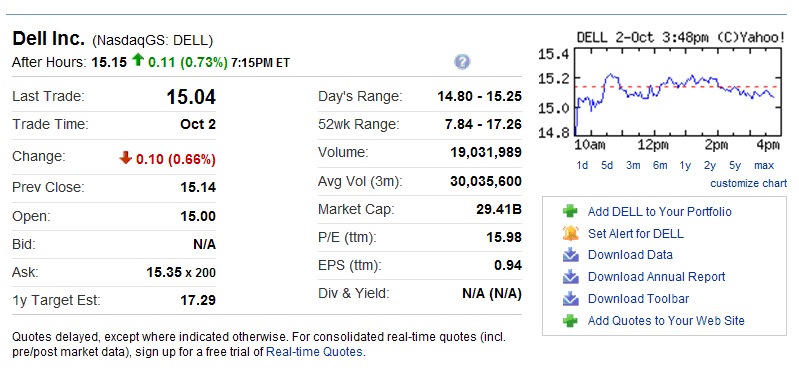

How to read a Stock Quote

A typical stock quote conveys at least the following information (example of Dell Incorporation) on 04/23/2009 at 10:11 AM EST:

1. DELL - DELL INC.

2. Exchange: NASDAQ NMS

3. Delay: at least 15 minutes

4. Last price: 10.40 at 10:11 EST

5. Change: Down 0.23 (-2.16%)

6. Previous close: 10.63

7. Open: 10.60

8. Day’s range: 10.40 - 10.66

9. 52-week range: 7.84 - 26.04

10. Volume: 2,771,121

11. Average volume (3-month): 31,144,500

12. Market Cap.: 20.29 billion

13. P/E: 8.33

14. EPS: 1.25

15. Yield: N/A

1. Ticker symbol. In this case the company is Dell Incorporation, a leading technology company which designs, develops, and manufactures information technology systems and services. The ticker symbol has 4 letters, showing that the stock is probably listed on the NASDAQ market exchange.

2. Exchange. Dell is indeed traded on NASDAQ. The acronym NMS stands for Nasdaq Market System.

3. Delay. Unlike a real-time quote for trading, a typical stock quote is usually delayed at least 15 minutes and may be no longer accurate regarding the price level.

4. Last price. The last recorder ticker price. It can be either a bid (someone just sold at) or an ask price (someone just bought at).

5. Change. The price change compared to the closing price of the previous business day.

6. Previous close. Official closing price of the previous business day. This price does not take account of changes after hours.

7. Open. The opening price at 9:30 AM EST when the market opens.

8. Day’s range. Price range during the day from the opening up to the actual time of the stock quote.

9. 52-week range. Price range during the last 52-week time frame. The current price level gives the idea of how the stock is performing during a year. A new high means the stock is reaching the highest price during a year, and a new low indicates the stock is dropping to the lowest level in the last 52 weeks.

10. Volume. The number of shares traded so far during the day. The amount of shares exchanged on a transaction, either buy or sell, is counted once.

11. Average volume (3-month). The daily average of shares traded during the last 3-month time frame. This number provides the information of how investors are interested about the stock.

12. Market cap. Also called market capitalization, the number is simply the multiplication of the current stock price with its outstanding shares. Obviously, market capitalization changes along with stock price.

13. P/E ratio. P/E ratio is computed by dividing the stock market capitalization (current stock price multiplied with its shares outstanding) by its after-tax earnings over a period of 12 months. This number measures how expensive the stock is. P/E ratio shows the trailing performance of a stock but when using with earnings estimate of future periods, the value is called forward P/E.

14. EPS. Earnings per share is calculated by dividing the total earnings of a stock is by its number of outstanding shares. EPS can be “trailing” or calculated for the previous year, “current” for the actual year, or “forward” for an estimate of the following year. EPS can also be calculated quarterly or annually.

15. Yield. Yield is defined as the percentage of annual return rate of an investment. For a stock, yield is the percentage of dividends divided by the purchased price. Most of big caps stocks has a yield while startup or growth companies have none, since earnings are retained for company’s re-investment purposes.

Fig.1. A typical stock quote

How to read a real-time stock quote

When entering an order, either buy or sell, the brokerage firm always provides a real-time quote which gives typically the following information:

1. The stock ticker symbol. For example, DELL (Dell Computer Corp)

2. The market exchange. In this case the NASDAQ NM

3. Bid price. The price that the dealer is willing to buy at.

4. Ask price. The price that the dealer is willing to sell at.

5. Bid size. The corresponding number of shares with the bid price, meaning that the dealer’s bid price is available only up to the bid size offered.

6. Ask size. The corresponding number of shares with the ask price, or the number of shares available with that ask price.

7. Last. The last trade recorded. Either a buy or a sell and only one side of the transaction is recorded.

8. Tick. The movement of the stock price which can be upward (uptick) or downward (downtick). This fluctuation reveals the trend of the stock price. In March 1938, the SEC instituted the uptick rule stating that short selling is allowed only when the stock is on an uptick movement. The measure aimed to slow down the short selling process and preventing short sellers to drive down a stock price at an accelerated speed. The measure was repealed in April 2007 following a period of relative market tranquility. However, because of the market meltdown in 2008, the SEC is considering to reinstate the uptick rule.

9. Change. The difference between the current price and the last trade. The number is expressed by an absolute number, either positive or negative and the percentage of the change.

10. Volume. The number of shares traded up to the real time quote.

Fig.2. Streamlined quote from TD Ameritrade

Useful tips using stock quote

Reading a real-time stock quote may help the investor in many ways:

1. To trade inside the spread. The spread is the difference between bid and ask price. Spread could be very narrow (only one or a few cents) for visible and high volume stocks (such as FB or HP) or very wide in the tune of a few dollars for volatile and illiquid stocks (specially stock options). Usually the investor sells at the bid price and buy at the ask price, however if he/she is not in a rush to buy or sell the stock right away, he/she may enter a limit order inside the spread. As we know, the spread is the market makers' profit and in many cases, when they can match buyers & sellers together, as long as they can still profit, the transaction can be done most of the times.

2. Percentage off the 52-wek high or low.. By looking at the 52-week range, investors can the percentage of the actual price compare to its 52-week high or low. In the case above, we see that the 52-week range of DELL is 7.84 - 17.26 and its actual price is 15.04. Therefore DELL is actually traded (1-15.04/17.26) 13% below its 52-week high or {(15.04/17.26)-1} 87% above its 52-week low. This gives the investor an idea how much the stock has moved over the last year and whether its is trading near the top, middle or bottom of the range. In this case, it shows that DELL is gathering a significant momentum and might be a good buy. Many traders like to buy a stock reaching or breaking its 52-week high.

3.Volume. Volume of a stock refers to the number of shares changing hands up to the moment of the stock quote. Volume is very important for technical analysts who used it as a measure to assess the worth of a market move. If a stock price moves significantly either up or down with high or very higher volume than normal, that move is very meaningful.

4. Market Capitalization. Also called "marketcap," this is simply the stock price multiplied by the number of shares outstanding. Because stock price fluctuates by every second, so does the market capitalization. A company with a market capitalization of more than $10 billion is called a "large cap, or big cap." Between $2 billion to $10 billion is considered a "mid-cap." From $300 to $2 billion belongs to the pack of small caps. Below $300 are micro or nano caps.

A "blue chip," evidently a big cap, is a nationally recognized company with a well established financial status. Also, a "blue chip" company generally sells high quality, widely accepted products and services. The term "blue chip" derives from the game of poker where blue chips have the highest value. Blue chip stocks are known to weather economic downturns and still operate profitably to survive economic crisis.

Classification of stock shares

A company’s stock shares are classified as:

Authorized shares. The total number of shares that a company has filed when incorporated. For example company A may declare 2 million shares when filing for incorporation.

Outstanding shares. The number of shares that the company has sold through IPO when going public. For example, the company may have sold 1 million shares to raise capital.

Authorized but non-issued shares. The remaining 1 million shares that do not count in financial statements. The company reserves those shares to grant to key employees in form of options which will become outstanding shares after a period of time set by the company (vesting time).

New accounting transparency policy suggests those options should be counted (diluted) in ratios’ calculation. For example, the company may grant ½ million options shares to key employees.

Treasury shares. The last ½ million shares that the company keeps in its records which do not belong to any individual. When needed, the company may sell again these treasury shares through secondary offerings.

When the company buys back its shares, they are “retired” and become treasury shares. The result is that the number of outstanding shares is reduced.

Stocks buyback is a common way for a company to return wealth to shareholders. When a company repurchases its own stocks, the “retired” shares become treasury shares and no longer belong to anyone. The obvious result is the reduction of the number of outstanding shares in the market. When this happens, the relative ownership stake of each investor increases because there are fewer shares, or claims, on the earnings of the company. A significant stock repurchase may improve the company financial ratios by reducing the number of shares outstanding.

Typically, there are two ways for a company to buyback its stocks:

1/ Tender offer. Shareholders may be asked to tender a portion or all of their shares within a time limit. Shareholders may state the number and price of the shares they are willing to accept. Once the company received all offers, it will find a right mix to buy the shares, usually at a premium compared to the market price.

2/ Open market. The company may buy at the open market its own shares, directly supporting and improving the stock price.

Stock repurchasing is usually considered a good sign for a company but there were cases that a buyback program is merely an attempt to prop up ratios, providing short-term relief to an ailing stock price or to get out from under excessive dilution.

How to read a Stock Quote

A typical stock quote conveys at least the following information (example of Dell Incorporation) on 04/23/2009 at 10:11 AM EST:

1. DELL - DELL INC.

2. Exchange: NASDAQ NMS

3. Delay: at least 15 minutes

4. Last price: 10.40 at 10:11 EST

5. Change: Down 0.23 (-2.16%)

6. Previous close: 10.63

7. Open: 10.60

8. Day’s range: 10.40 - 10.66

9. 52-week range: 7.84 - 26.04

10. Volume: 2,771,121

11. Average volume (3-month): 31,144,500

12. Market Cap.: 20.29 billion

13. P/E: 8.33

14. EPS: 1.25

15. Yield: N/A

1. Ticker symbol. In this case the company is Dell Incorporation, a leading technology company which designs, develops, and manufactures information technology systems and services. The ticker symbol has 4 letters, showing that the stock is probably listed on the NASDAQ market exchange.

2. Exchange. Dell is indeed traded on NASDAQ. The acronym NMS stands for Nasdaq Market System.

3. Delay. Unlike a real-time quote for trading, a typical stock quote is usually delayed at least 15 minutes and may be no longer accurate regarding the price level.

4. Last price. The last recorder ticker price. It can be either a bid (someone just sold at) or an ask price (someone just bought at).

5. Change. The price change compared to the closing price of the previous business day.

6. Previous close. Official closing price of the previous business day. This price does not take account of changes after hours.

7. Open. The opening price at 9:30 AM EST when the market opens.

8. Day’s range. Price range during the day from the opening up to the actual time of the stock quote.

9. 52-week range. Price range during the last 52-week time frame. The current price level gives the idea of how the stock is performing during a year. A new high means the stock is reaching the highest price during a year, and a new low indicates the stock is dropping to the lowest level in the last 52 weeks.

10. Volume. The number of shares traded so far during the day. The amount of shares exchanged on a transaction, either buy or sell, is counted once.

11. Average volume (3-month). The daily average of shares traded during the last 3-month time frame. This number provides the information of how investors are interested about the stock.

12. Market cap. Also called market capitalization, the number is simply the multiplication of the current stock price with its outstanding shares. Obviously, market capitalization changes along with stock price.

13. P/E ratio. P/E ratio is computed by dividing the stock market capitalization (current stock price multiplied with its shares outstanding) by its after-tax earnings over a period of 12 months. This number measures how expensive the stock is. P/E ratio shows the trailing performance of a stock but when using with earnings estimate of future periods, the value is called forward P/E.

14. EPS. Earnings per share is calculated by dividing the total earnings of a stock is by its number of outstanding shares. EPS can be “trailing” or calculated for the previous year, “current” for the actual year, or “forward” for an estimate of the following year. EPS can also be calculated quarterly or annually.

15. Yield. Yield is defined as the percentage of annual return rate of an investment. For a stock, yield is the percentage of dividends divided by the purchased price. Most of big caps stocks has a yield while startup or growth companies have none, since earnings are retained for company’s re-investment purposes.

Fig.1. A typical stock quote

How to read a real-time stock quote

When entering an order, either buy or sell, the brokerage firm always provides a real-time quote which gives typically the following information:

1. The stock ticker symbol. For example, DELL (Dell Computer Corp)

2. The market exchange. In this case the NASDAQ NM

3. Bid price. The price that the dealer is willing to buy at.

4. Ask price. The price that the dealer is willing to sell at.

5. Bid size. The corresponding number of shares with the bid price, meaning that the dealer’s bid price is available only up to the bid size offered.

6. Ask size. The corresponding number of shares with the ask price, or the number of shares available with that ask price.

7. Last. The last trade recorded. Either a buy or a sell and only one side of the transaction is recorded.

8. Tick. The movement of the stock price which can be upward (uptick) or downward (downtick). This fluctuation reveals the trend of the stock price. In March 1938, the SEC instituted the uptick rule stating that short selling is allowed only when the stock is on an uptick movement. The measure aimed to slow down the short selling process and preventing short sellers to drive down a stock price at an accelerated speed. The measure was repealed in April 2007 following a period of relative market tranquility. However, because of the market meltdown in 2008, the SEC is considering to reinstate the uptick rule.

9. Change. The difference between the current price and the last trade. The number is expressed by an absolute number, either positive or negative and the percentage of the change.

10. Volume. The number of shares traded up to the real time quote.

Fig.2. Streamlined quote from TD Ameritrade

Useful tips using stock quote

Reading a real-time stock quote may help the investor in many ways:

1. To trade inside the spread. The spread is the difference between bid and ask price. Spread could be very narrow (only one or a few cents) for visible and high volume stocks (such as FB or HP) or very wide in the tune of a few dollars for volatile and illiquid stocks (specially stock options). Usually the investor sells at the bid price and buy at the ask price, however if he/she is not in a rush to buy or sell the stock right away, he/she may enter a limit order inside the spread. As we know, the spread is the market makers' profit and in many cases, when they can match buyers & sellers together, as long as they can still profit, the transaction can be done most of the times.

2. Percentage off the 52-wek high or low.. By looking at the 52-week range, investors can the percentage of the actual price compare to its 52-week high or low. In the case above, we see that the 52-week range of DELL is 7.84 - 17.26 and its actual price is 15.04. Therefore DELL is actually traded (1-15.04/17.26) 13% below its 52-week high or {(15.04/17.26)-1} 87% above its 52-week low. This gives the investor an idea how much the stock has moved over the last year and whether its is trading near the top, middle or bottom of the range. In this case, it shows that DELL is gathering a significant momentum and might be a good buy. Many traders like to buy a stock reaching or breaking its 52-week high.

3.Volume. Volume of a stock refers to the number of shares changing hands up to the moment of the stock quote. Volume is very important for technical analysts who used it as a measure to assess the worth of a market move. If a stock price moves significantly either up or down with high or very higher volume than normal, that move is very meaningful.

4. Market Capitalization. Also called "marketcap," this is simply the stock price multiplied by the number of shares outstanding. Because stock price fluctuates by every second, so does the market capitalization. A company with a market capitalization of more than $10 billion is called a "large cap, or big cap." Between $2 billion to $10 billion is considered a "mid-cap." From $300 to $2 billion belongs to the pack of small caps. Below $300 are micro or nano caps.

A "blue chip," evidently a big cap, is a nationally recognized company with a well established financial status. Also, a "blue chip" company generally sells high quality, widely accepted products and services. The term "blue chip" derives from the game of poker where blue chips have the highest value. Blue chip stocks are known to weather economic downturns and still operate profitably to survive economic crisis.

Classification of stock shares

A company’s stock shares are classified as:

Authorized shares. The total number of shares that a company has filed when incorporated. For example company A may declare 2 million shares when filing for incorporation.

Outstanding shares. The number of shares that the company has sold through IPO when going public. For example, the company may have sold 1 million shares to raise capital.

Authorized but non-issued shares. The remaining 1 million shares that do not count in financial statements. The company reserves those shares to grant to key employees in form of options which will become outstanding shares after a period of time set by the company (vesting time).

New accounting transparency policy suggests those options should be counted (diluted) in ratios’ calculation. For example, the company may grant ½ million options shares to key employees.

Treasury shares. The last ½ million shares that the company keeps in its records which do not belong to any individual. When needed, the company may sell again these treasury shares through secondary offerings.

When the company buys back its shares, they are “retired” and become treasury shares. The result is that the number of outstanding shares is reduced.

Stocks buyback is a common way for a company to return wealth to shareholders. When a company repurchases its own stocks, the “retired” shares become treasury shares and no longer belong to anyone. The obvious result is the reduction of the number of outstanding shares in the market. When this happens, the relative ownership stake of each investor increases because there are fewer shares, or claims, on the earnings of the company. A significant stock repurchase may improve the company financial ratios by reducing the number of shares outstanding.

Typically, there are two ways for a company to buyback its stocks:

1/ Tender offer. Shareholders may be asked to tender a portion or all of their shares within a time limit. Shareholders may state the number and price of the shares they are willing to accept. Once the company received all offers, it will find a right mix to buy the shares, usually at a premium compared to the market price.

2/ Open market. The company may buy at the open market its own shares, directly supporting and improving the stock price.

Stock repurchasing is usually considered a good sign for a company but there were cases that a buyback program is merely an attempt to prop up ratios, providing short-term relief to an ailing stock price or to get out from under excessive dilution.

Loading