Tìm Kiếm Bài Đã Đăng

Diễn Đàn Cựu Sinh Viên Quân Y

© 2015

© 2015

Chapter Twelve

Investment Strategies

Buy-and-Hold

Buy-and-Hold is the simplest way of investing in the stock market. Basically an investor after due diligence and intense research about a company, just buy the stock and hold it for a long or very long period until the company fundamentals change or when the investor needs the money. If the holding period is more than a year, buy-and hold strategy can be called long-term investing and involves some tax advantages over short-term investing.

The Buy-and-Hold strategy is based on the concept that the market is efficient and all factors have been accounted into the stock price. Timing the market will be no use and may hurt the overall rate of return. What will make the stock price to appreciate is the company's performance itself. Furthermore, with buy-and-hold the investor does not have to pay taxes on capital gains because the stocks are not sold and profits are not realized yet. This can be considered as a case of tax-deferred.

Peter Lynch or Warren Buffett are examples of buy-and-hold advocates and have built their fortunes by researching undervalued companies, buy their stocks and hold them indefinitely.

Nonetheless, with the spread of the Internet, fast execution of stocks trading, and the 2007-2008 financial crisis, buy-and-hold is becoming less popular since early 2009. Anyone who invested into the market in early 2007 and hold the stocks long-term has seen his portfolio performing rather poorly for the last 6 years.

Day trading strategy

Day trading means the act of buying and selling the same stock within the same trading day. In this case, the investor is called a day-trader and uses mostly technical analysis to determine entry and exit points. He seeks to make quick profits by leveraging large amounts of money to take advantage of small price movements in highly liquid and volatile stocks. In general, not all stocks are good candidates for day trading and there are some criteria that should be considered such as:

Visibility. CNBC ticker symbol during a trading day can help to know which stocks are visible, meaning on-the-spotlight and attractive to investors.

Liquidity. Liquidity means that the stock can be sold or bought readily with tight spreads (difference between bid and ask price) and low slippage (difference between the expected price of a trade, and the actual price executed).

Volatility. Volatility is a measure of the daily price range. High volatility means that the stock price can swing from low of the day to high of the day widely and sometimes numerous times in a typical trading day. More volatility can also lead to more profits, or losses.

Volume. High volume, especially a volume spike shows that traders are supporting the price at a certain level and if the stock price goes up with high volume, it usually means that the uptrend can be sustained for a while. The opposite is equally true, a downtrend with high volume can trigger short-sellers who in turn exaggerate the sell-off.

Short-term trading strategy

Short-term trading can be categorized as any securities investment held longer than a day but shorter than a year. In reality, although there are no exact statistics, most of the active traders fall into this category. Short-term trading is very appealing due to the fact that the investor can cash in profits right away when the stock has been appreciated significantly or cut losses when the stock is down and reaches the investor's threshold of endurance. Time is not of essence in this case.

We can tell that shot-term trading requires both fundamentals analysis and technical analysis. Usually, the investor picks the stock after ample research about the company and uses technical analysis to get a good entry point. When fundamentals are no longer suitable or technical analysis signals a reversal of the uptrend, the investor tends to get out of the stock.

Short-term trading involves some significant issues regarding taxes, especially when the investor realizes short-term capital gains. Unlike long-term capital gains which can benefit from low tax rates, usually from 0, 15, and 20% for most taxpayers, short-term capital gains are treated by the IRS as ordinary income with tax rates ranging from 10 to 39.6% depending on the investor's total taxable income.

In case of capital losses, either long or short-term, the IRS allows the investor to use up to $3,000 per year to reduce the taxable income. Any additional losses can be carried forward into future years to offset either future capital gains or another $3,000 each year from the investor's ordinary income.

Diversification

A common saying in the stock market denotes: "Don't put all your eggs in the same basket." This idiom sums up the reasons of diversification, meaning that an investor should never put all his resources in one stock, or a very few companies but at least spread out his investment into many stocks in many industries. By doing so, he can avoid to be wiped out if the only (or too few) stocks that he is holding got beating or even went bankrupt.

The real issue here is how many stocks should an investor hold to be diversified enough. There is no right answers but by common sense (and according to many analysts), not only a portfolio should have at least a certain number of stocks ranging from 4-8 but the companies should also encompass different industries unrelated one to another. For example, banking, technology, healthcare, consumer discretionary, consumer staples, transportation etc... Some authors assert that holding too many stocks (for example a dozen) in a portfolio doesn't help much to improve the performance, although it may have some sort of diversification. In this case, buying an index ETF such as SPY (S&P 500) makes more sense.

Another consideration that an investor should be aware is that a well diversified portfolio doesn't mean that there will be no risk. In the financial world, there are two kinds of risks: (1) systemic risk, and (2) specific risks. Systemic risk involves macroeconomics or the risk of collapse of an entire market due to market difficulties in general. Diversification cannot reduce systemic (or systematic) risk embedded into the market itself. Specific risk, sometimes referred as unsystematic risk is a risk that affects a very small number of assets, or a single company. We may refer specific risk as microeconomics risk. Diversification can indeed help to eliminate specific risks.

Dollar-cost averaging (DCA)

This is an investment strategy aims to reduce the impact of volatility of the market upon a stock. By dividing the total sum to be invested into the market (or a stock) in equal amount at regular intervals, DCA limits the risk of a substantial loss resulting from investing the whole "lump-sum" before the fall of the market or stock. As noted, DCA works well if the market or the stock is on a downtrend but the contrary may happen. If the market or stock is on an uptrend, then DCA will raise the average cost of the investment and the investor ends up with a lower rate of return than had he invested the whole amount available.

DCA has been a subject of debate among financial scholars and analysts without definitive conclusion about the validity of the strategy. However, most agree that with small investors that can afford only small amounts of money to invest periodically, for example the average retirement situation for most ordinary people. DCA into sound companies helps those investors to build up a "nest-egg" over a long time given the historical market value increase of the market in general.

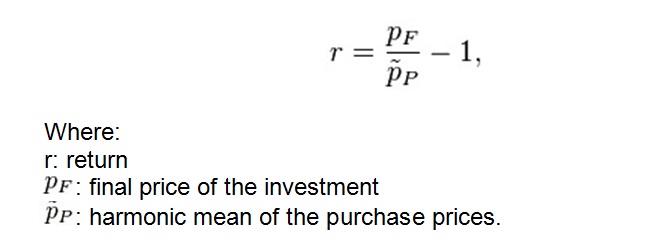

Formula to compute the return of DCA: (see image)

We see that the return (r) is higher when is higher or is lower. It means that if at the last investment if the stock price is at its highest and the harmonic mean of prices is low, due to certain times that the stock price was at its lowest, DCA works at its best scenario.

Direct Stock Purchase Program (DSPP)

DSPP is a strategy to buy stock directly from companies or through a transfer agent to bypass broker firms and avoid commission fees. DSPP often have minimum deposit requirements that can be as low as $100 per monthly. Commission fees also are minimal, most of the companies that offer DSPP charge only as low as $1 per trade.

DSPP comes usually with dividend reinvestment plan, meaning that all dividends received will be used to buy more shares of the company. This feature enhances greatly DSPP performance.

DSPP is a suitable way for investors who have only a small, fixed amount of money to invest each month and by doing so, those investors are using the dollar cost averaging strategy. The process of buying stocks through DSPP may be defined as follows:

1. To choose which company to buy. Obviously you should pick large, big cap companies that have been in business for decades, if not centuries. Dow Jones companies are examples of good candidates for DSPP.

2. Check their websites. Using the "Search" feature, look up "direct stock purchase" or "dividend reinvestment program." The alternative way is to look on the investor page.

3. Most companies are actually using transfer agents to administer their DSPPs. Find their links and follow instructions for opening an account.

Below are useful links that help investors to search for companies that offer DSPPs and DRIP (Dividend Reinvestment Program):

https://directstockpurchase.blogspot.com/2007/08/where-to-purchase-direct-stock-plans.html

https://noload.info/

https://www-us.computershare.com/investor/3x/plans/planslist.asp?bhjs=1&fla=0&stype=dspp

Investment Strategies

Buy-and-Hold

Buy-and-Hold is the simplest way of investing in the stock market. Basically an investor after due diligence and intense research about a company, just buy the stock and hold it for a long or very long period until the company fundamentals change or when the investor needs the money. If the holding period is more than a year, buy-and hold strategy can be called long-term investing and involves some tax advantages over short-term investing.

The Buy-and-Hold strategy is based on the concept that the market is efficient and all factors have been accounted into the stock price. Timing the market will be no use and may hurt the overall rate of return. What will make the stock price to appreciate is the company's performance itself. Furthermore, with buy-and-hold the investor does not have to pay taxes on capital gains because the stocks are not sold and profits are not realized yet. This can be considered as a case of tax-deferred.

Peter Lynch or Warren Buffett are examples of buy-and-hold advocates and have built their fortunes by researching undervalued companies, buy their stocks and hold them indefinitely.

Nonetheless, with the spread of the Internet, fast execution of stocks trading, and the 2007-2008 financial crisis, buy-and-hold is becoming less popular since early 2009. Anyone who invested into the market in early 2007 and hold the stocks long-term has seen his portfolio performing rather poorly for the last 6 years.

Day trading strategy

Day trading means the act of buying and selling the same stock within the same trading day. In this case, the investor is called a day-trader and uses mostly technical analysis to determine entry and exit points. He seeks to make quick profits by leveraging large amounts of money to take advantage of small price movements in highly liquid and volatile stocks. In general, not all stocks are good candidates for day trading and there are some criteria that should be considered such as:

Visibility. CNBC ticker symbol during a trading day can help to know which stocks are visible, meaning on-the-spotlight and attractive to investors.

Liquidity. Liquidity means that the stock can be sold or bought readily with tight spreads (difference between bid and ask price) and low slippage (difference between the expected price of a trade, and the actual price executed).

Volatility. Volatility is a measure of the daily price range. High volatility means that the stock price can swing from low of the day to high of the day widely and sometimes numerous times in a typical trading day. More volatility can also lead to more profits, or losses.

Volume. High volume, especially a volume spike shows that traders are supporting the price at a certain level and if the stock price goes up with high volume, it usually means that the uptrend can be sustained for a while. The opposite is equally true, a downtrend with high volume can trigger short-sellers who in turn exaggerate the sell-off.

Short-term trading strategy

Short-term trading can be categorized as any securities investment held longer than a day but shorter than a year. In reality, although there are no exact statistics, most of the active traders fall into this category. Short-term trading is very appealing due to the fact that the investor can cash in profits right away when the stock has been appreciated significantly or cut losses when the stock is down and reaches the investor's threshold of endurance. Time is not of essence in this case.

We can tell that shot-term trading requires both fundamentals analysis and technical analysis. Usually, the investor picks the stock after ample research about the company and uses technical analysis to get a good entry point. When fundamentals are no longer suitable or technical analysis signals a reversal of the uptrend, the investor tends to get out of the stock.

Short-term trading involves some significant issues regarding taxes, especially when the investor realizes short-term capital gains. Unlike long-term capital gains which can benefit from low tax rates, usually from 0, 15, and 20% for most taxpayers, short-term capital gains are treated by the IRS as ordinary income with tax rates ranging from 10 to 39.6% depending on the investor's total taxable income.

In case of capital losses, either long or short-term, the IRS allows the investor to use up to $3,000 per year to reduce the taxable income. Any additional losses can be carried forward into future years to offset either future capital gains or another $3,000 each year from the investor's ordinary income.

Diversification

A common saying in the stock market denotes: "Don't put all your eggs in the same basket." This idiom sums up the reasons of diversification, meaning that an investor should never put all his resources in one stock, or a very few companies but at least spread out his investment into many stocks in many industries. By doing so, he can avoid to be wiped out if the only (or too few) stocks that he is holding got beating or even went bankrupt.

The real issue here is how many stocks should an investor hold to be diversified enough. There is no right answers but by common sense (and according to many analysts), not only a portfolio should have at least a certain number of stocks ranging from 4-8 but the companies should also encompass different industries unrelated one to another. For example, banking, technology, healthcare, consumer discretionary, consumer staples, transportation etc... Some authors assert that holding too many stocks (for example a dozen) in a portfolio doesn't help much to improve the performance, although it may have some sort of diversification. In this case, buying an index ETF such as SPY (S&P 500) makes more sense.

Another consideration that an investor should be aware is that a well diversified portfolio doesn't mean that there will be no risk. In the financial world, there are two kinds of risks: (1) systemic risk, and (2) specific risks. Systemic risk involves macroeconomics or the risk of collapse of an entire market due to market difficulties in general. Diversification cannot reduce systemic (or systematic) risk embedded into the market itself. Specific risk, sometimes referred as unsystematic risk is a risk that affects a very small number of assets, or a single company. We may refer specific risk as microeconomics risk. Diversification can indeed help to eliminate specific risks.

Dollar-cost averaging (DCA)

This is an investment strategy aims to reduce the impact of volatility of the market upon a stock. By dividing the total sum to be invested into the market (or a stock) in equal amount at regular intervals, DCA limits the risk of a substantial loss resulting from investing the whole "lump-sum" before the fall of the market or stock. As noted, DCA works well if the market or the stock is on a downtrend but the contrary may happen. If the market or stock is on an uptrend, then DCA will raise the average cost of the investment and the investor ends up with a lower rate of return than had he invested the whole amount available.

DCA has been a subject of debate among financial scholars and analysts without definitive conclusion about the validity of the strategy. However, most agree that with small investors that can afford only small amounts of money to invest periodically, for example the average retirement situation for most ordinary people. DCA into sound companies helps those investors to build up a "nest-egg" over a long time given the historical market value increase of the market in general.

Formula to compute the return of DCA: (see image)

We see that the return (r) is higher when is higher or is lower. It means that if at the last investment if the stock price is at its highest and the harmonic mean of prices is low, due to certain times that the stock price was at its lowest, DCA works at its best scenario.

Direct Stock Purchase Program (DSPP)

DSPP is a strategy to buy stock directly from companies or through a transfer agent to bypass broker firms and avoid commission fees. DSPP often have minimum deposit requirements that can be as low as $100 per monthly. Commission fees also are minimal, most of the companies that offer DSPP charge only as low as $1 per trade.

DSPP comes usually with dividend reinvestment plan, meaning that all dividends received will be used to buy more shares of the company. This feature enhances greatly DSPP performance.

DSPP is a suitable way for investors who have only a small, fixed amount of money to invest each month and by doing so, those investors are using the dollar cost averaging strategy. The process of buying stocks through DSPP may be defined as follows:

1. To choose which company to buy. Obviously you should pick large, big cap companies that have been in business for decades, if not centuries. Dow Jones companies are examples of good candidates for DSPP.

2. Check their websites. Using the "Search" feature, look up "direct stock purchase" or "dividend reinvestment program." The alternative way is to look on the investor page.

3. Most companies are actually using transfer agents to administer their DSPPs. Find their links and follow instructions for opening an account.

Below are useful links that help investors to search for companies that offer DSPPs and DRIP (Dividend Reinvestment Program):

https://directstockpurchase.blogspot.com/2007/08/where-to-purchase-direct-stock-plans.html

https://noload.info/

https://www-us.computershare.com/investor/3x/plans/planslist.asp?bhjs=1&fla=0&stype=dspp

Click image to enlarge

Loading