Chapter Thirteen

The Chicken Farming Strategy

Everyone must wonder is there any "bullet-proof" investment strategy that would guarantee a decent rate of return over time and most of all, "risk-free?" Unfortunately, the answer is no and there is always the factor of risk/reward involved. The more an investor wants reward, the more he should take risk. In the financial world, a risk-free investment is measured by the rate of return of US Treasury long bonds (10 years), currently (2014) less than 3%. Any expected rate of return more than that required a certain level of risk.

However, after quite some time involved in the stock market, I have discovered a strategy that may be close to the "Holy Grail" of the stock market. The idea originated a long time ago from my mother who used to raise chicken as a home business. After the initial startup phase, every week she was able to buy a new clutch of chicks and sell a brood of chickens about eight-week old until one day, a couple of years later, they all died because of avian sickness. Although not successful, my mom's operation still impressed me greatly, knowing that had she managed her poultry business better, she could have had a great business model in which the input at one end was small chicks while the output at the other end is mature chickens ready for sale and she would have made decent profits after all costs.

A second idea also from my mother was that she used to buy gold every month as a way to save during difficult times of war in our country. Any month that gold price has come down, she seemed very please because she was able to buy more gold ounces. She was convinced that eventually gold price will go up over time and she had had opportunities to buy more gold. As far as she was concerned was the number of gold ounces that she possessed. Little I knew this was exactly the basic concept of "dollar cost averaging."

Applied to the stock market, stocks shares can be "sick" too, when the company is not doing well and/or even goes bankrupt. Thus, the vehicle to use with the strategy must be a stock that can never go bankrupt or can hold its value like gold over time.

In summary, the Chicken Farming Investment Strategy relies on 4 basic principles: (1) Time value of money, (2) Tax deferred feature, (3) Dollar cost averaging and (4) Diversification

Time value of money

Time is money. This idiom is very true in the financial world because unless kept "under-the-mattress," the value of money appreciates over time due to the interest factor. The future value (FV) of a certain amount of money is always higher than its present value (PV). Any financial planning always takes account of opportunity cost, meaning the cost of an alternative benefit that have been forgone in order to pursue the project. In this case, it could be the actual market rate of interest for a similar project or at least the risk-free rate of interest of US long bonds will be used to calculate the economic profit of such financial project.

The formula to compute the future value of money is as follow:

PV = FV / (2+i)^n

Where:

PV = Present Value

FV = Future Value

i = rate of interest

n = number of periods

Let's apply some numbers into the formula. For example, how much a present value of $500 will become in 20 years with a market interest of 10%?

FV = $500 x (1+0.1)^20 = $3.363

In summary, a $500 today can worth $3,363 in 20 years assuming a rate of interest of 10%.

The power of tax-deferred factor

The tax-deferred factor is very essential to a long-term investment. For example if an investor has to pay taxes annually 30% on the 10% interest that he can earn, the true rate of return will be 7% and its $500 PV will become only:

FV = $500 (1+0.07)^20 = $1,934

$3,363 - $1,934 = $1,429 or 42%. The more the time, the greater the loss because of taxes.

The advantage of Dollar Cost Averaging (DCA)

As explained on the previous chapter, DCA has some advantages that cannot be disregarded:

-DCA can reduce the impact of volatility of the market upon the financial vehicle, in this case a stock.

-DCA allows small investors with limited financial resources to invest periodically a small fixed amount of money that can grow substantially over time.

Let's take an example:

An investor bought 100 shares of ABC company at $6 per share. Let assume that during the year the stock price fluctuates and at times goes down to $3 but ends the year back at $6. Thus, the investor has no gain nor loss.

But if the investor divided its investment into 12 monthly purchases of $50 each, he may be able to buy more shares when the stock is down and benefits when the stock price is back to its initial level (table).

|

Period |

Assumed Stock Price |

Number of Shares Bought |

Value |

|

Jan |

6 |

8.333 |

|

|

Feb |

5 |

10 |

|

|

Mar |

4 |

12.5 |

|

|

Apr |

5 |

10 |

|

|

May |

4 |

12.5 |

|

|

June |

3 |

16.666 |

|

|

July |

4 |

12.5 |

|

|

Aug |

5 |

10 |

|

|

Sep |

6 |

8.333 |

|

|

Oct |

5 |

10 |

|

|

Nov |

5 |

10 |

|

|

Dec |

6 |

8.333 |

|

|

Total |

|

129.16 |

774.99 |

Therefore, by using DCA, the investor has made a profit of $174.99 or 29%.

Now, on the other hand, if the stock price keeps on rising and ends the year at a higher level, obviously the investor will make less than had he put all its investment at the beginning. But at least he still has gains and peace of mind.

The worst scenario of DCA is that the stock price never come back and kept losing its value. If that happened, DCA per se is not to be blamed but rather the investor's judgment to pick such a losing stock. A good stock or better, a good index ETF will eventually makes new highs over time. The investor has to be patient and time will work for him.

Diversification

One of the most important requirements of Chicken Farming Strategy (CFS) is that the financial vehicle used to apply the strategy will never go bankrupt. Therefore, individual stocks cannot be used, no matter how stable and large are they. Instead, EFTs mimicking market indexes such as Dow Jones (DIA), S&P 500 (SPY), or Nasdaq 100 (QQQ) are suitable for CFS. They follow major market averages and always appreciate over time, if the investor can hold them for a long time, at least 10 years or more in the future.

But, unless the investor has enough cash, those stocks do not come cheap and involve significant commission fees. To circumvent these inconveniences and bypass middlemen, i.e. brokerage firms, there is still a perfect financial vehicle that can be used for CFS: The Vanguard 500 Index Fund (VFIAX)! This is a low-cost way to gain diversified exposure to the U.S. equity market. The fund invests into the 500 largest companies of the US which encompass a broad band of industries and account for about 3/4 of the whole US market value. Putting your money in VFIAX gives you the following advantages:

-Most of the fees (purchase fee, redemption fee...) are waived.

-Vanguard charges you only a nominal fee of $1 per transaction.

-Dividends (close to 2% annually) are automatically reinvested.

-Automatic weekly or monthly deposits as low as $100. Therefore it is very suitable for low to mid-income investors who can only afford a small amount of money every month to invest.

-As long as the shares are not sold, all gains are not realized and not subject to tax reporting, thus some kind of tax-deferred feature. Every year, the fund rebalances its holdings and may sell some stocks but usually the changes are minimal and the tax issue is not significant.

-The only inconvenience is that the initial investment required is $10,000.

Illustration

A small investor can afford to set aside $400 every month and invest into the stock market. Let supposed that he was able to achieve consistently a 10% rate of return, which is doable if he put his money into Vanguard S&P 500 (VFIAX), after 20 years (or 240 terms) his first $400 will become:

$400 (1+0.1/12)^240 = $2,931

And his "annuity" will become, using the parameters of N: number of payments; I: Interest rate; Y: yearly; PMT: payment:

N=>20x12; I/Y=> 0.1/12; PMT=> 400 --->

FV = $306,278 and his costs: $400x12x20 = $96,000

In theory, after accumulating after 20 years, the investor doesn't need to invest anymore and can start to cash out $2,931 - $400 (reinvestment) = $2,521 monthly and forever! Even when he passes away, his siblings can inherit the monthly payments generations after generations...

Obviously, the inflation factor must be considered and can be mitigated by rebalancing periodically monthly payments and redemptions. Also, because of the volatility of the market, the investor should cash out monthly only what has become his $400 20 years earlier and not exactly the amount of $2,521 (FIFO, First in First Out, concept).

The CFS strategy can be used for retirement purposes and/or to build up a college fund for new-born children. It can be used also as a family emergency fund.

In summary, the CFS has had the advantages of:

-Bypassing commission fees

-Tax-deferred

-Affordable for most investors

-Reinvestment of dividends

-Diversification

-Consistent and decent rate of return

-And most of all, cannot go bankrupt

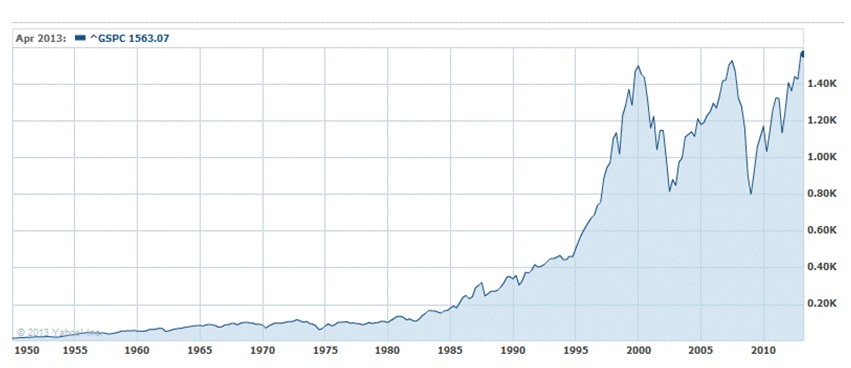

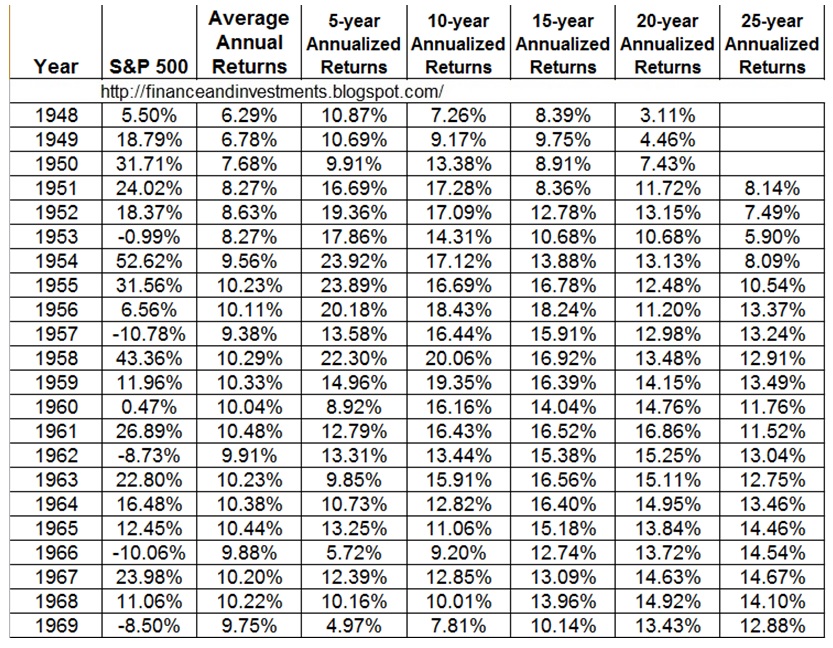

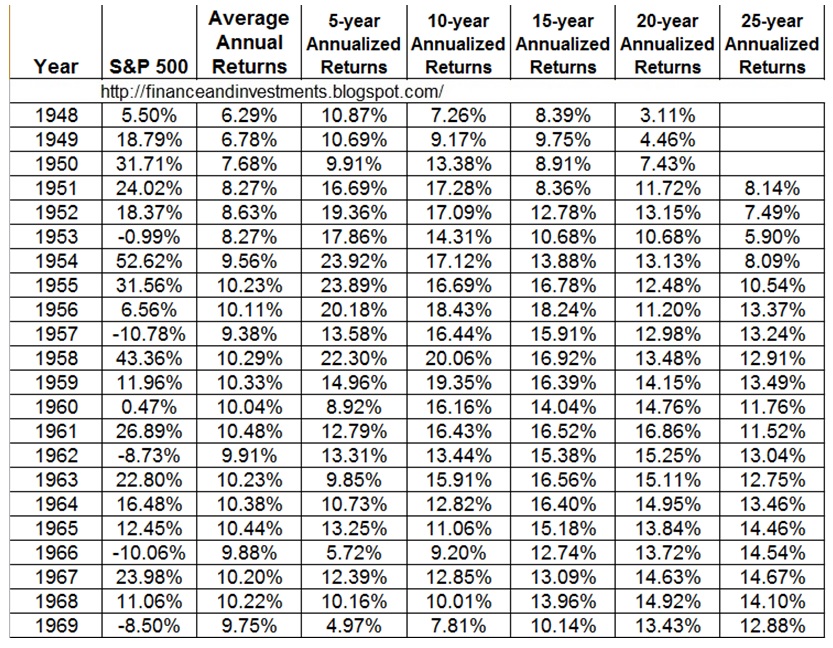

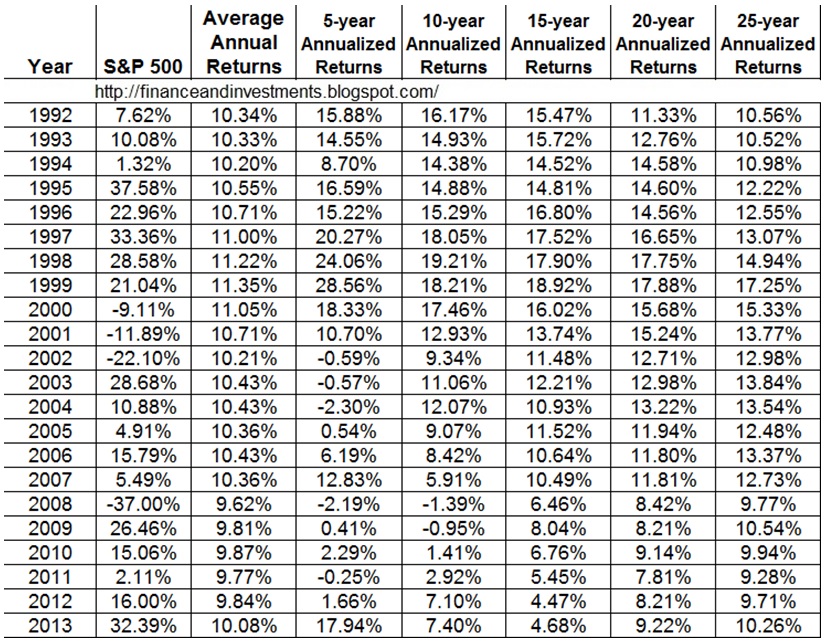

Performance of S&P 500

To demonstrate that VFIAX is the perfect financial vehicle to apply CFS, following is the historical performance of S&P 500 since 1948 to 2013. It clearly shows that a 10% expected rate of return is rather conservative with a time frame of 20 years and more.

https://financeandinvestments.blogspot.com/2014/02/historical-annual-returns-for-s-500.html

Also, when analyzing S&P 500 chart since 1950 to date, any way you slice it, a time frame of 20 years or more will always show that the index has been appreciated. The last 20-year time frame would be the period of 1993-2013 in which the S&P 500 started at 438 (01/04/1993) and closed at 1848 (12/31/2013) or 322%. Any dips were opportunities to buy more shares at a discount price.